by Amy Roy | Oct 11, 2018 | Charitable Giving, Featured, Foundations, Linked In |

“Plans are nothing; planning is everything.” Dwight D. Eisenhower A little planning can go a long way. Did you know that making a planned gift will not only help ensure the health of the organizations you support long into the future but can also provide benefits to you? What exactly is planned giving? And, how can you benefit from it? In short, a planned gift is the type of gift that requires a little more thought than simply writing a check or processing a credit card. It’s a gift, as the name implies, that you’ve planned for – you’ve given consideration about from where and how the gift will be received. The great thing about planned giving is that it allows you to give wisely and take advantage of tax strategies and giving vehicles that provide benefit to you while at the same time maximize the amount of charitable dollars that can benefit an organization. Planned giving can come in many forms and fall under three general categories. Outright gifts: One of the most basic and common is a gift of appreciated stock or securities that allow you to pass on the gains to your favorite organization. Making a charitable gift of appreciated stock that you’ve held for a year or more saves you the tax burden as you avoid realizing the capital gains, yet still allows you to deduct the current value of the stock if you itemize. Gifts that return income: Other types of planned gifts can be set up to provide a stream of income either to you or the organization you choose to support. ...

by Andrew Hibel | Apr 12, 2018 | Events, Featured, Linked In |

When your nonprofit organization’s CEO says “Do you take this strategic plan to have and to hold?,” can you say “I do!” with conviction? Being called upon to fund strategies that did not fully consider donors and development is justifiably every fundraiser’s nightmare. There should be a symbiosis between an organization’s strategic plans and its fundraising expectations, but that’s not always the case. Using real-world, cautionary tales of planning processes that succeeded or went awry and how fundraisers responded, this session equips organization executives, board members and development leaders with the perspective they need to ensure that strategic plans drive fundraising success – and vice versa. Join us for this free, 2-hour seminar, May 14, 9:00 am – 11:00 am presented by Doug Diefenbach, Principal, Diefenbach Communications Strategies Forefront, 208 South LaSalle Street, #1540 Chicago, IL Click here to reserve your spot today! Doug Diefenbach is an accomplished consultant with special expertise in the area of nonprofit and philanthropic marketing. For more than 30 years, in both executive and consulting roles, he has helped a wide range of organizations to develop, meet and exceed their goals for strategic alignment, brand visibility, constituent engagement and philanthropic...

by Amy Roy | Jul 10, 2017 | Charitable Giving, Featured, Linked In |

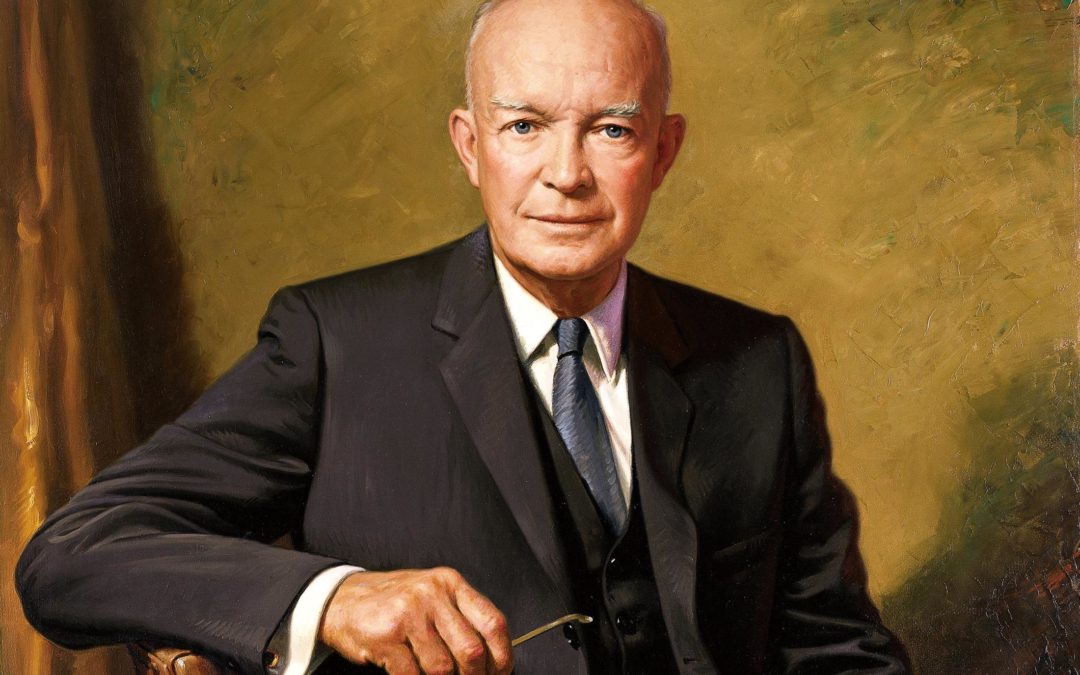

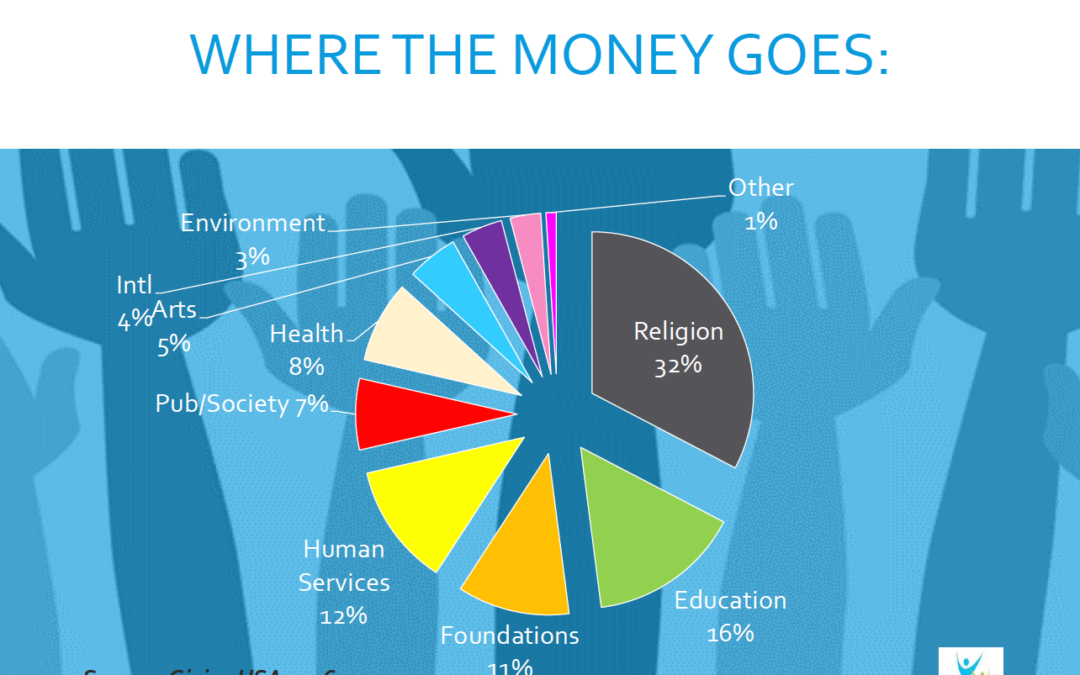

In our ongoing effort to help make planned giving more accessible, collaborative and beneficial for charities, we hosted a workshop led by fundraising expert Laura Kaufman. The fourth in our series of free seminars and workshops, Engaging Your Donors for Life-Long Giving, invited Chicago-area nonprofits to learn about strategies and tactics for engaging donors over a long time horizon. Laura covered three major areas with us: The Individual Donor (ID) Marketplace. What is Engagement and Why Does It Matter? Driving Donor Engagement. State of Giving: National and Chicago Area Trends Nonprofits are experiencing more giving than ever before. In each category, numbers are on the rise, year over year. According to Giving USA’s report, giving by bequest is up 2.1%, giving my individuals is up 3.8% and total giving has increased 4.4%. The next question is, where is the money going? This chart from Giving USA breaks it down nicely. Drilling down to the specific Chicago area market, the Chicago Community Trust shared some interesting data. Compared to a national average of 59%, 73% of Chicagoans give to charity. 49% of Chicago households volunteer and 78% of dollars donated by Chicagoans stay in the region. What is Engagement: Often overlooked, donor engagement is absolutely critical for the long-term health of an organization. While nonprofit fundraisers are busy managing many initiatives for their organization, donor engagement must be the core of their day-to-day. Research shows doing so will make capital and annual giving campaigns go more smoothly, netting better results. The donor engagement cycle can be broken down into these simple components: Recruit/Inspire, Learn, Engage, Ask, Thank, Repeat, Upgrade and...

by Rosalyn Lambert | Jul 28, 2015 | Donor-Advised Funds, Featured |

Recurring gifts are nothing new. Numerous nonprofit organizations have shown big results with recurring gift donors. One study of online contributions found recurring gift donors gave 42 percent more annually than one-time contributors. But there is a problem – and an opportunity. One of the biggest areas of donation growth is donor-advised funds. But donor-advised fund advisors – the people you will need to solicit for a donation – cannot make a legally binding pledge using their fund. The advisors can only make “grant advisements.” This is an important legal restriction. But here’s a secret. Most donor-advised fund administrators fulfill almost all advisor grant advisements. That is, charities get the grant. Likely less than one percent of advisements get rejected. The few grant advisements going unfilled are almost always because: The donor requests a grant going to a nonprofit that isn’t a 501(c)3 charity; The donor is receiving something of value for the donation; or, in rare cases, The administrator has restrictions on what 501(c)3 charities can be supported (something donors would be made aware of when they create the fund). If you’re a 501(c)3 charity in good standing with the IRS and do not give anything of value in return for the donation, you should almost always get the grant. Where is the opportunity? Most donor-advised funds offer grant advisement pre-scheduling of recurring donations. This is a growing area with increasing numbers of scheduled contributions. It’s a big opportunity for you! Successfully Solicit Donor-Advised Fund Recurring Grants As you design your donor-advised fund recurring grant campaign there are three considerations (among standard ones) to keep top of mind....

by Rosalyn Lambert | Jan 13, 2015 | Linked In |

Learn how donor-advised funds offer an important contribution to nonprofit fundraising #charity