by Amy Roy | Oct 11, 2018 | Charitable Giving, Featured, Foundations, Linked In |

“Plans are nothing; planning is everything.” Dwight D. Eisenhower A little planning can go a long way. Did you know that making a planned gift will not only help ensure the health of the organizations you support long into the future but can also provide benefits to you? What exactly is planned giving? And, how can you benefit from it? In short, a planned gift is the type of gift that requires a little more thought than simply writing a check or processing a credit card. It’s a gift, as the name implies, that you’ve planned for – you’ve given consideration about from where and how the gift will be received. The great thing about planned giving is that it allows you to give wisely and take advantage of tax strategies and giving vehicles that provide benefit to you while at the same time maximize the amount of charitable dollars that can benefit an organization. Planned giving can come in many forms and fall under three general categories. Outright gifts: One of the most basic and common is a gift of appreciated stock or securities that allow you to pass on the gains to your favorite organization. Making a charitable gift of appreciated stock that you’ve held for a year or more saves you the tax burden as you avoid realizing the capital gains, yet still allows you to deduct the current value of the stock if you itemize. Gifts that return income: Other types of planned gifts can be set up to provide a stream of income either to you or the organization you choose to support. ...

by Amy Roy | Jul 10, 2017 | Charitable Giving, Featured, Linked In |

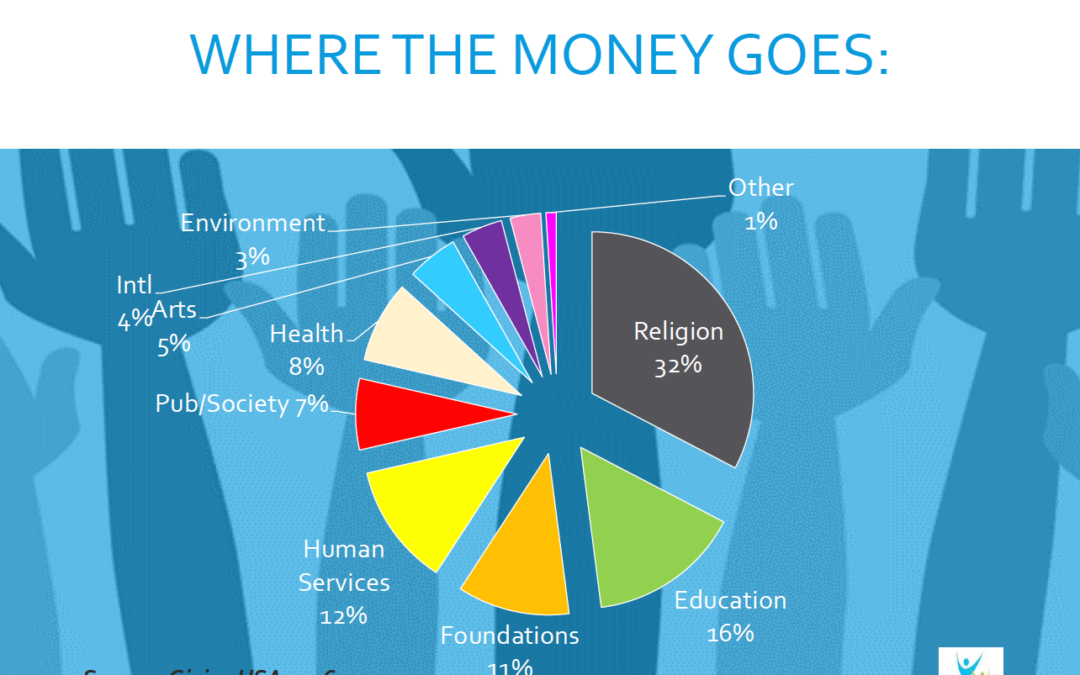

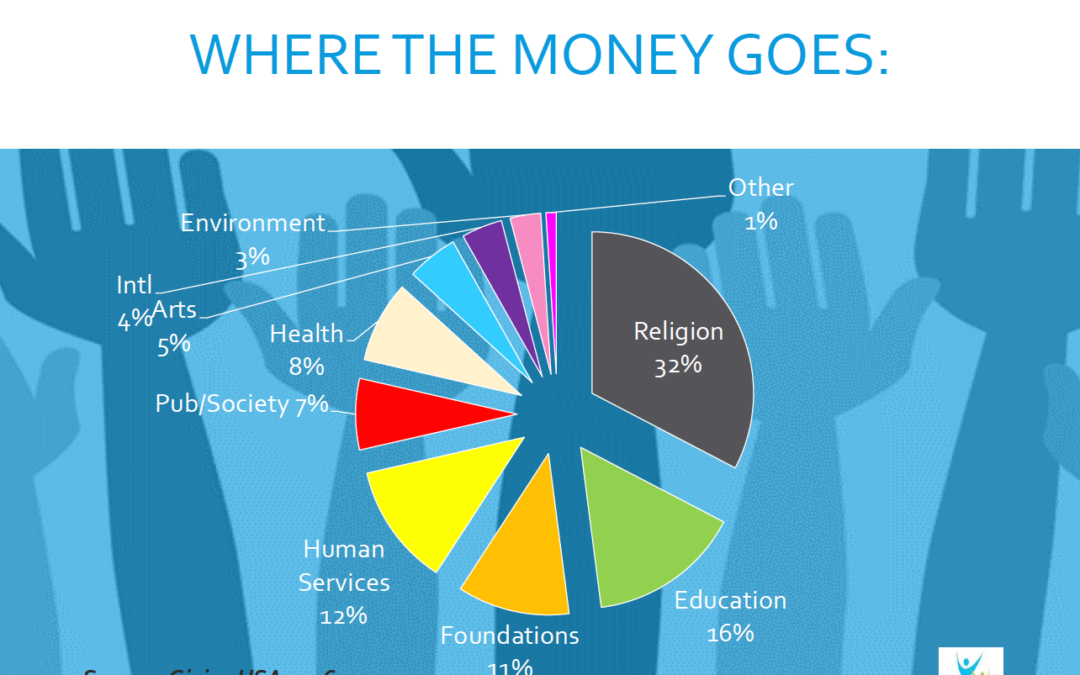

In our ongoing effort to help make planned giving more accessible, collaborative and beneficial for charities, we hosted a workshop led by fundraising expert Laura Kaufman. The fourth in our series of free seminars and workshops, Engaging Your Donors for Life-Long Giving, invited Chicago-area nonprofits to learn about strategies and tactics for engaging donors over a long time horizon. Laura covered three major areas with us: The Individual Donor (ID) Marketplace. What is Engagement and Why Does It Matter? Driving Donor Engagement. State of Giving: National and Chicago Area Trends Nonprofits are experiencing more giving than ever before. In each category, numbers are on the rise, year over year. According to Giving USA’s report, giving by bequest is up 2.1%, giving my individuals is up 3.8% and total giving has increased 4.4%. The next question is, where is the money going? This chart from Giving USA breaks it down nicely. Drilling down to the specific Chicago area market, the Chicago Community Trust shared some interesting data. Compared to a national average of 59%, 73% of Chicagoans give to charity. 49% of Chicago households volunteer and 78% of dollars donated by Chicagoans stay in the region. What is Engagement: Often overlooked, donor engagement is absolutely critical for the long-term health of an organization. While nonprofit fundraisers are busy managing many initiatives for their organization, donor engagement must be the core of their day-to-day. Research shows doing so will make capital and annual giving campaigns go more smoothly, netting better results. The donor engagement cycle can be broken down into these simple components: Recruit/Inspire, Learn, Engage, Ask, Thank, Repeat, Upgrade and...

by Rosalyn Lambert | Jan 13, 2015 | Donor Intent, Donor-Advised Funds, Featured |

In my life as a development officer I hated donor-advised funds. I felt they took money from my mission, made me miss out on my goals and just made things difficult. Who were these people with their funds – and how could I find them? As donor-advised funds have grown more popular – and I have become more familiar with them – I’ve moved from respect to real appreciation. I see donor-advised funds in an entirely new light because I better understand their important role – and potential – in charitable giving. Let’s address common criticisms first. Common Criticisms Money (That’s What I Want) I agree donor-advised funds seem like a charitable bank account or just a financial tool that saves taxes. But the overall annual rate of donor-advised fund contributions – the “payout rate” to charity – regularly exceeds the payout from private foundations. Sometimes the donor-advised fund payout rate is more than double the amount that private foundations donate with their 5% minimum. Waiting on a Friend If your concern is waiting for the money, then you should know in practice donor-advised funds compare favorably with many types of charitable giving vehicles, including private foundations, charitable remainder trusts and charitable lead trusts. In fact, many donor advised funds – including The Advise Us Fund – have rules that require donors to make advisements at least annually. Good Times Bad Times When it comes to tough financial times, think of donor-advised funds as deep pockets that keep our nonprofit missions motoring. In fact, donors often give more to donor-advised funds when they have an economic windfall, like a...