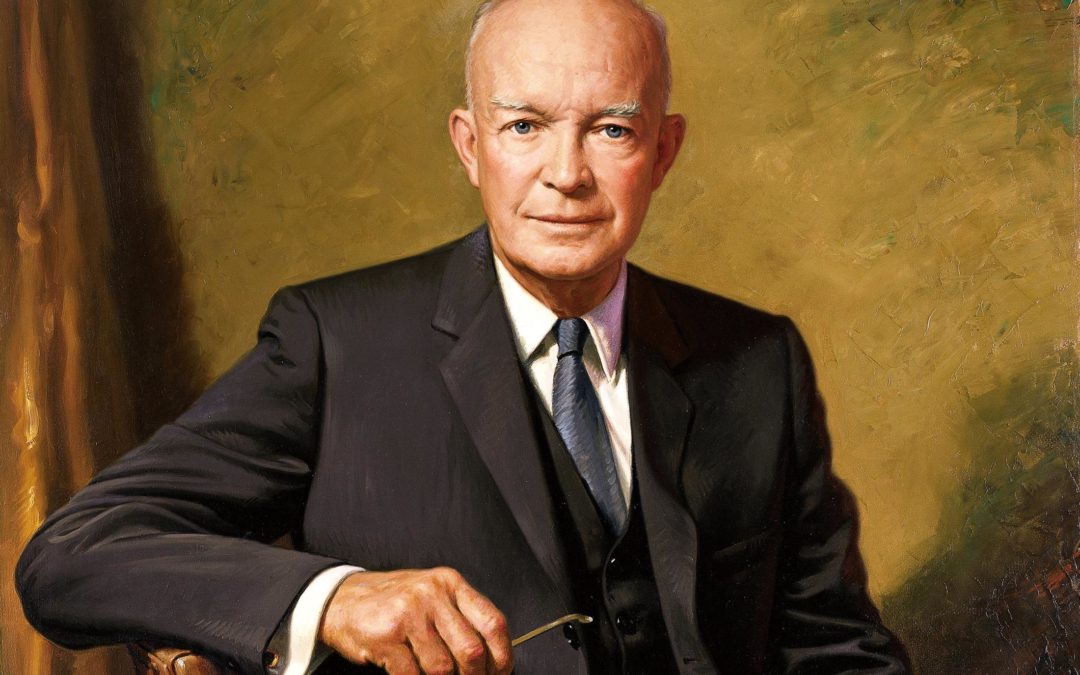

by Amy Roy | Oct 11, 2018 | Charitable Giving, Featured, Foundations, Linked In |

“Plans are nothing; planning is everything.” Dwight D. Eisenhower A little planning can go a long way. Did you know that making a planned gift will not only help ensure the health of the organizations you support long into the future but can also provide benefits to you? What exactly is planned giving? And, how can you benefit from it? In short, a planned gift is the type of gift that requires a little more thought than simply writing a check or processing a credit card. It’s a gift, as the name implies, that you’ve planned for – you’ve given consideration about from where and how the gift will be received. The great thing about planned giving is that it allows you to give wisely and take advantage of tax strategies and giving vehicles that provide benefit to you while at the same time maximize the amount of charitable dollars that can benefit an organization. Planned giving can come in many forms and fall under three general categories. Outright gifts: One of the most basic and common is a gift of appreciated stock or securities that allow you to pass on the gains to your favorite organization. Making a charitable gift of appreciated stock that you’ve held for a year or more saves you the tax burden as you avoid realizing the capital gains, yet still allows you to deduct the current value of the stock if you itemize. Gifts that return income: Other types of planned gifts can be set up to provide a stream of income either to you or the organization you choose to support. ...

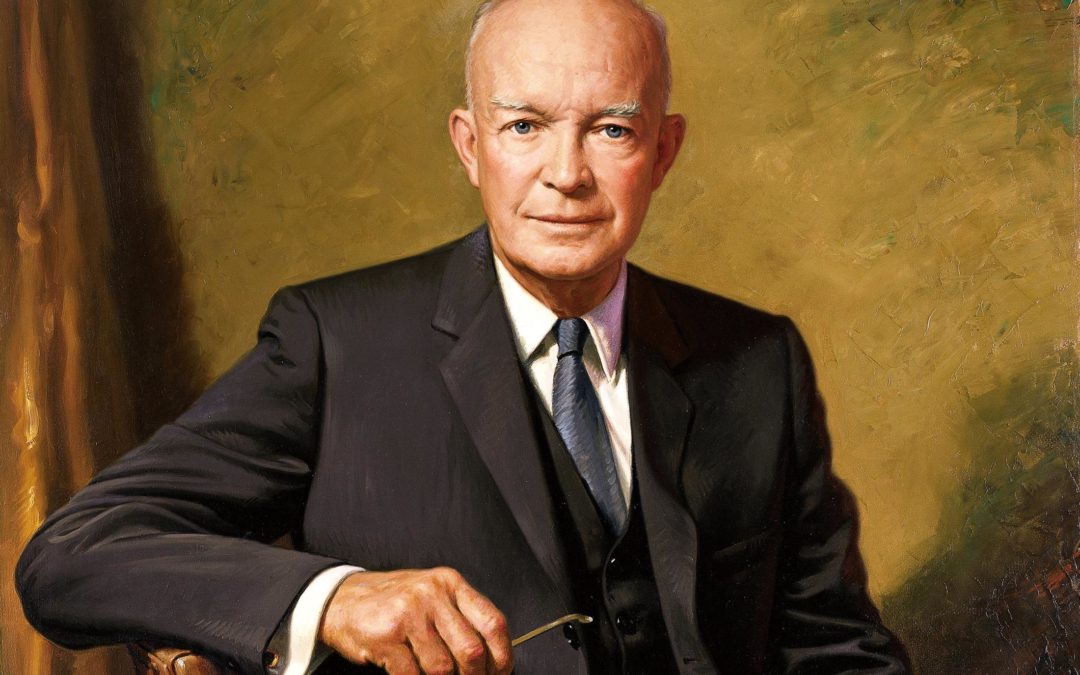

by Andrew Hibel | Aug 29, 2016 | Featured, Linked In |

Being a middle-aged man with a family, my wife and I have been reviewing our estate plans with the intention of revising them. 15 years ago, our attorney-led us through a relatively simple process. This time, I am searching for an app to help me manage the process. An app that will give us what we need to do if we plug in answers to a few multiple choice questions. Unfortunately, this app does not exist and I was stuck for a while trying to find out the status of our plans. In lieu a magical app, I have found the following helped me to break the cycle of procrastination in estate planning: Review and Assemble Current Documents – This may seem simple but this can be complex with wills, trusts, retirement plans and life insurance. Make sure you know where everything is and what is in it. A good summary can be found on RetiredBrains.com. Take a Current Inventory of All Assets – Simply put, in the worst case scenario, it is important to let people know where things are. The inventory should also be a part of your documents. RetiredBrains.com also has a great checklist for items to include. Think of The Important People – We live our lives with and, in many ways, for our loved ones. If you look at the wallpaper of my smartphone, you will see a picture of my loved ones. I’m sure your loved ones occupy similar spaces and you may want them to occupy similar spaces in your estate plans. Think of The Values You Want to Pass On—We donate...

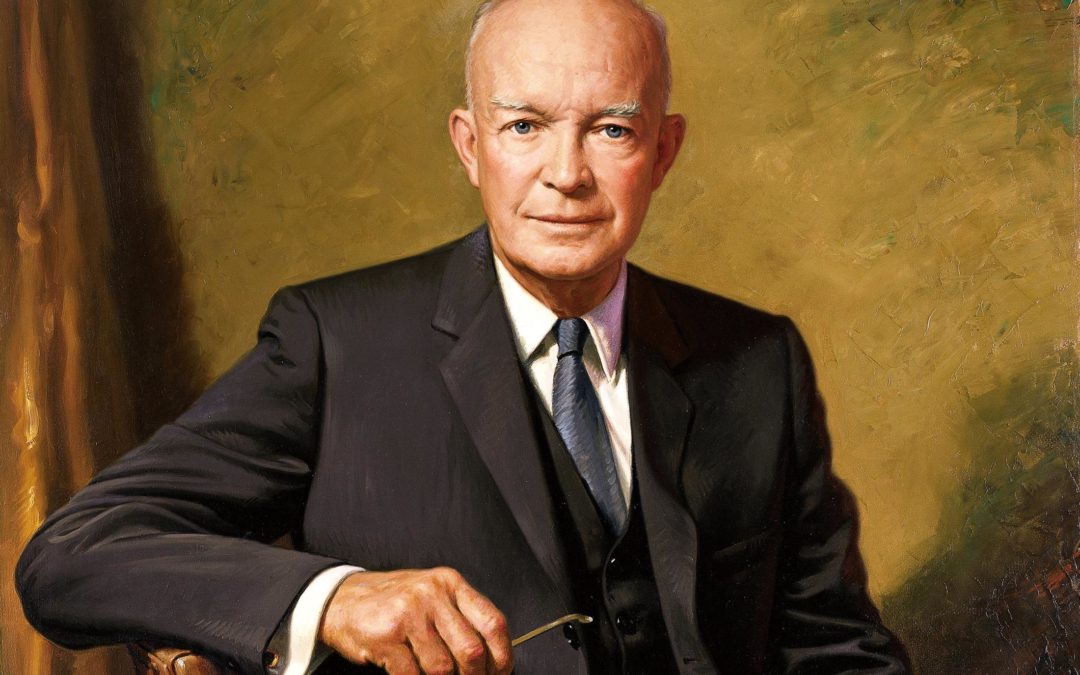

by Andrew Hibel | Aug 27, 2015 | Donor Intent, Donor-Advised Funds, Featured |

Don’t have time now? Do it later. Something came up and you want to give now? Go ahead. Do you have a foundation or a charitable trust and want additional flexibility? You can have it. Donor-advised funds offer donors like you great options! Giving to Your Donor-Advised Fund and Getting More for Charity You can make a gift to your donor-advised fund when it works for you. Make gifts of appreciated assets, employee bonuses, or proceeds from business sales when it’s most convenient and when you want to take a charitable deduction that year. Donor-advised funds help maximize your donations to charity through favorable tax treatment. You can deduct up to 50% of your adjusted gross income (AGI) for cash gifts and up to 30% of AGI for gifts of appreciated securities held at least a year. That means you can have more money to give to the charities you care most about. Making Grant Advisements to Charity Then you can advise grants. Your options? Give to any of more than one million IRS qualified 501(c)3 charities whenever you want. When can you give to charities? Now and in future years. How can you give? You can give now or schedule your charitable donations. Pre-scheduling one-time or recurring donations with a donor-advised fund is easy, popular and a huge opportunity to save your time! Using Donor-Advised Funds Along with Private Foundations and Charitable Trusts Many people have a donor-advised fund as a compliment to their existing foundation or charitable trust. Donor-advised funds also work well with checkbook giving, estate planning and IRA disbursements. Donor-advised funds can offer greater flexibility...

by Andrew Hibel | Apr 14, 2015 | Donor-Advised Funds, Featured |

Are you ready for a great opening day? Opening a donor-advised fund is easy, but covering the four bases below means you’ll get the most out of your fund starting from day one. Maximize Contribution Benefits with Your Donor-Advised Fund. Consider giving long-term (held over a year) appreciated securities to your donor-advised fund. This can avoid capital gains tax and maximize your charitable tax deduction. Keep the Right Tax Records – It’s Easy. Gifts to your donor-advised fund may be tax deductible. Those are the records to keep for your taxes. You do not need to keep tax records for grants you advise from your donor-advised funds to charities. You cannot claim donor-advised fund grants on your taxes. Schedule Grant Advisements – It’s Easy. Consider scheduling regular or future one-time charitable gifts. The grant advisement process is easy. You don’t have to remember and take the time to make a gift when you’re busy, like during the holiday season. Your Donor-Advised Fund Can Contribute to Estate Plans. Donor-advised funds offer flexible options for estate planning. Consider advising a grant from your fund to one or more charities that you care most about. Consider leaving the right to make grant advisements from the fund to your heir(s). Consider funding a donor-advised fund for your heir(s) from your estate to leave a legacy of charitable giving. Donor-advised funds make it easy to field a winning team with flexible and tax-efficient charitable giving. Covering the four bases above can make your donor-advised fund experience easier and more fulfilling starting opening day. ____________ Andrew Hibel serves as President and is the Founder of...