by Amy Roy | Oct 15, 2019 | Charitable Giving, Donor Impact, Featured, Linked In |

Catalyst: (noun) A person or thing that precipitates an event. The Advise Us Foundation is a nonprofit working as a catalyst to philanthropic giving for individuals and fellow nonprofits. As an organization that advances philanthropy, Advise Us is helping to change the world we live in by catalyzing donors’ intentions into support of non-profits’ important missions. From its earliest days, Advise Us has offered donor-advised fund giving to individuals to help them plan their philanthropic donations and legacies while at the same time take advantage of tax incentives that maximize philanthropic impact. Individuals are able to create or add to a charitable fund based on when it is a good time for them to give. They, in turn, can grant money out from their fund as donations to nonprofit organizations at any time they wish. Through the inspired generosity of those taking advantage of this charitable giving tool, the Advise Us Foundation has granted gifts to numerous organizations from the smallest start-ups to large educational institutions. Advise Us is also a catalyst for other charitable organizations by enabling them to create and use expanded giving options for their donors. The staff and volunteers of Advise Us have collectively decades of fundraising experience with a concentration on planned giving. Working in partnership with organizations to offer hands-on tactical advise and services affords these organizations the ability to increase their fundraising capabilities thereby increasing their mission-based impact for generations to come. The Advise Us Foundation also offers other means of direct support to the charitable community through educational seminars. With a special focus on small and medium-sized charities, our free educational...

by Andrew Hibel | Apr 2, 2019 | Featured, Linked In |

It’s Sunday afternoon and I’ve just driven three hours through the frozen heartland of Illinois to pay my last respects to someone who has recently passed away. It is sunny on what should be a dark day, but my drive has given me the opportunity to reflect on my 30 plus year relationship with the family that I am about to visit. This day, unlike so many others I have shared with the family, will be a sad one. I must say goodbye to someone who has shared his generosity and wisdom with me and has left an indelible mark on my life. It has been a privilege to be present in the life of this family and, now, in the passing of their loved one. This privilege is not lost on me. As a planned giving officer, I get to serve as a conduit and catalyst for the amazing philanthropic endeavors of those with whom I work. In doing so, I get to connect with incredible people and benefit immeasurably from their giving, not only as I gain a deeper understanding of their giving goals but also the fabric of life that holds us all together. Nonprofits do an excellent job of promoting how planned gifts, and their donors, achieve amazing results in saving and changing the lives of the recipients of philanthropic gifting. While planned gifts are often associated with tax planning, they still come with a story. There is a nature behind planned givers better seen as givers who are thoughtful about how their lives can touch the lives of others through their acts. Those who...

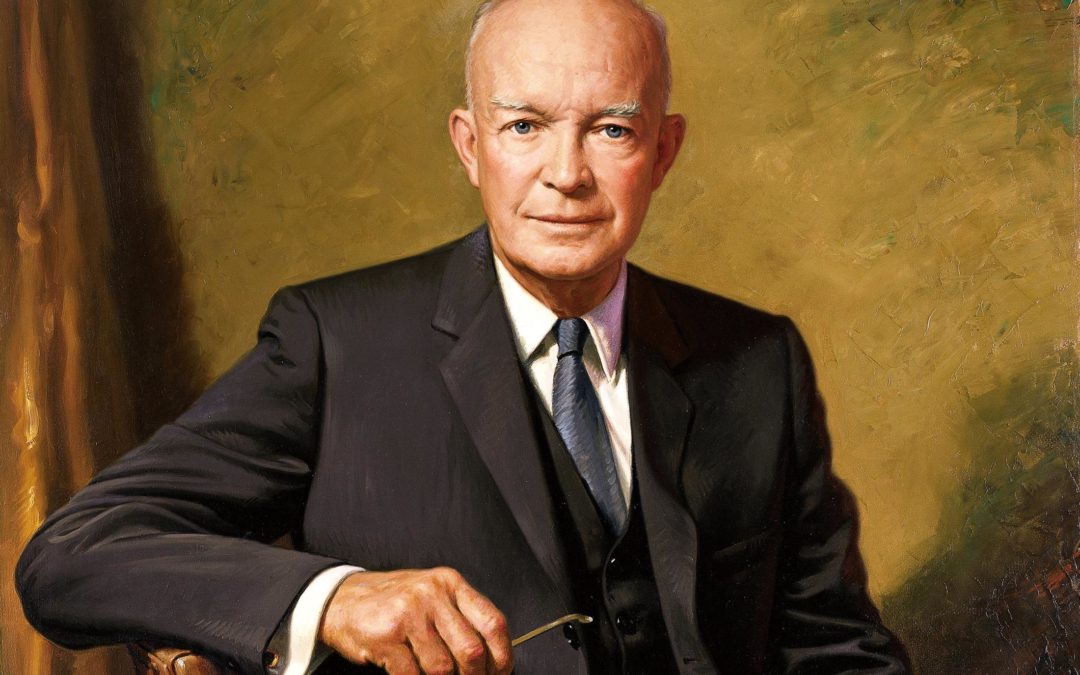

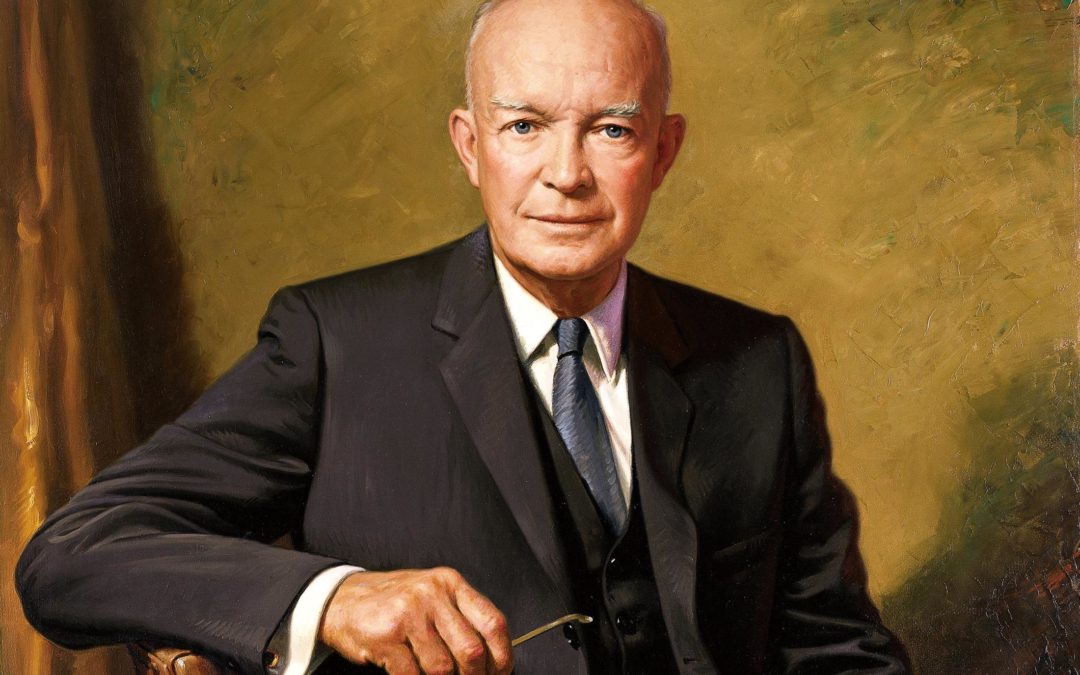

by Amy Roy | Oct 11, 2018 | Charitable Giving, Featured, Foundations, Linked In |

“Plans are nothing; planning is everything.” Dwight D. Eisenhower A little planning can go a long way. Did you know that making a planned gift will not only help ensure the health of the organizations you support long into the future but can also provide benefits to you? What exactly is planned giving? And, how can you benefit from it? In short, a planned gift is the type of gift that requires a little more thought than simply writing a check or processing a credit card. It’s a gift, as the name implies, that you’ve planned for – you’ve given consideration about from where and how the gift will be received. The great thing about planned giving is that it allows you to give wisely and take advantage of tax strategies and giving vehicles that provide benefit to you while at the same time maximize the amount of charitable dollars that can benefit an organization. Planned giving can come in many forms and fall under three general categories. Outright gifts: One of the most basic and common is a gift of appreciated stock or securities that allow you to pass on the gains to your favorite organization. Making a charitable gift of appreciated stock that you’ve held for a year or more saves you the tax burden as you avoid realizing the capital gains, yet still allows you to deduct the current value of the stock if you itemize. Gifts that return income: Other types of planned gifts can be set up to provide a stream of income either to you or the organization you choose to support. ...

by Andrew Hibel | Apr 12, 2018 | Events, Featured, Linked In |

When your nonprofit organization’s CEO says “Do you take this strategic plan to have and to hold?,” can you say “I do!” with conviction? Being called upon to fund strategies that did not fully consider donors and development is justifiably every fundraiser’s nightmare. There should be a symbiosis between an organization’s strategic plans and its fundraising expectations, but that’s not always the case. Using real-world, cautionary tales of planning processes that succeeded or went awry and how fundraisers responded, this session equips organization executives, board members and development leaders with the perspective they need to ensure that strategic plans drive fundraising success – and vice versa. Join us for this free, 2-hour seminar, May 14, 9:00 am – 11:00 am presented by Doug Diefenbach, Principal, Diefenbach Communications Strategies Forefront, 208 South LaSalle Street, #1540 Chicago, IL Click here to reserve your spot today! Doug Diefenbach is an accomplished consultant with special expertise in the area of nonprofit and philanthropic marketing. For more than 30 years, in both executive and consulting roles, he has helped a wide range of organizations to develop, meet and exceed their goals for strategic alignment, brand visibility, constituent engagement and philanthropic...

by Robert Freedman | Oct 2, 2017 | Charitable Giving, Donor Impact, Featured |

Over the past 10 days Jews around the world, myself included, observed the High Holy Days, Rosh Hashanah and Yom Kippur. During these days, I along with countless others, turned our thoughts towards Tikkun Olam (repairing the world) and Tzedakah (charity). Between the trio of powerful hurricanes that ripped through the Caribbean and the southeastern United States, powerful earthquakes devastating neighboring Mexico, and the ongoing struggles of poverty, poaching, and refugees in central Africa, there is no shortage of need around the world. As I reflected on my own faith traditions of helping those in need, I was prompted to think about what other faith traditions say about charitable giving, especially during their highest holy days. Uniting Christianity, Buddhism, Islam, and Judaism (amongst other things) is charitable giving. Here are some thoughts on charitable giving from these traditions: For Christians, the role of charity is first built on teachings in the Hebrew Bible. However, in addition to Hebrew teachings of performing mitzvahs are lessons in the New Testament. Jesus’s parables and actions also speak to the morality of charitable sentiments. The Gospel of Luke, for example, notes “love thy neighbor as thyself” and asks Jesus, “Who is my neighbor?” The lesson is that we are interconnected, everyone is my neighbor and thus all should be considered. Buddhists also see the interdependence of all things and have an awareness of the helplessness of those less fortunate. Practicing selflessness in this way is thought to increase one’s own merit and is also seen as an antidote to greed. Giving is an expression of the natural qualities of kindness and compassion....