by Amy Roy | Jul 10, 2017 | Charitable Giving, Featured, Linked In |

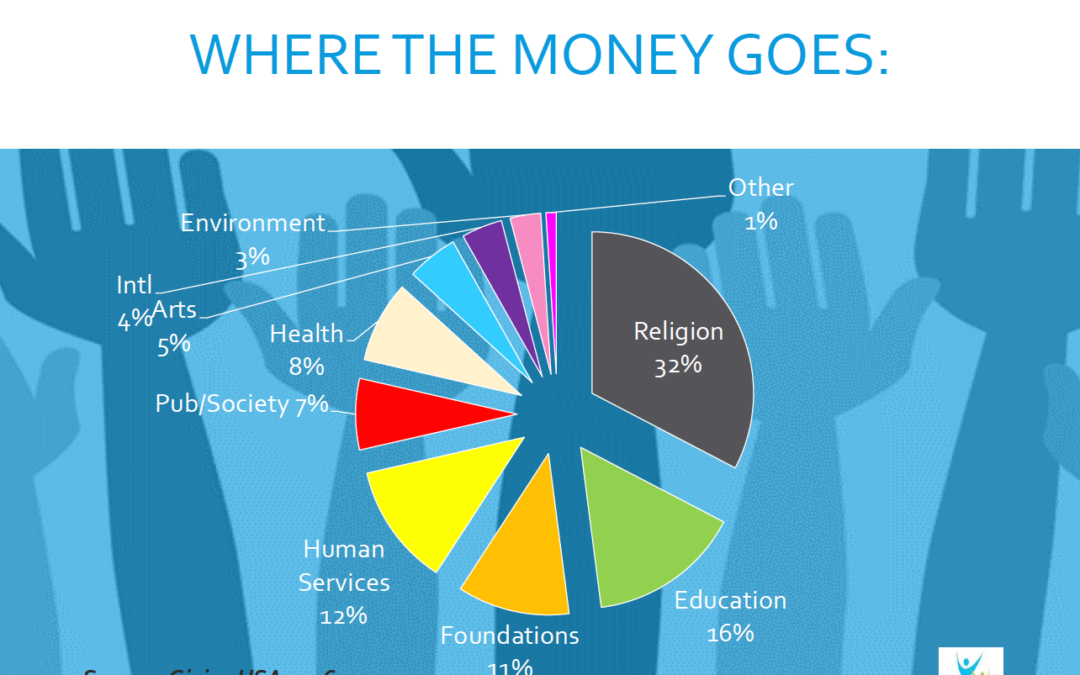

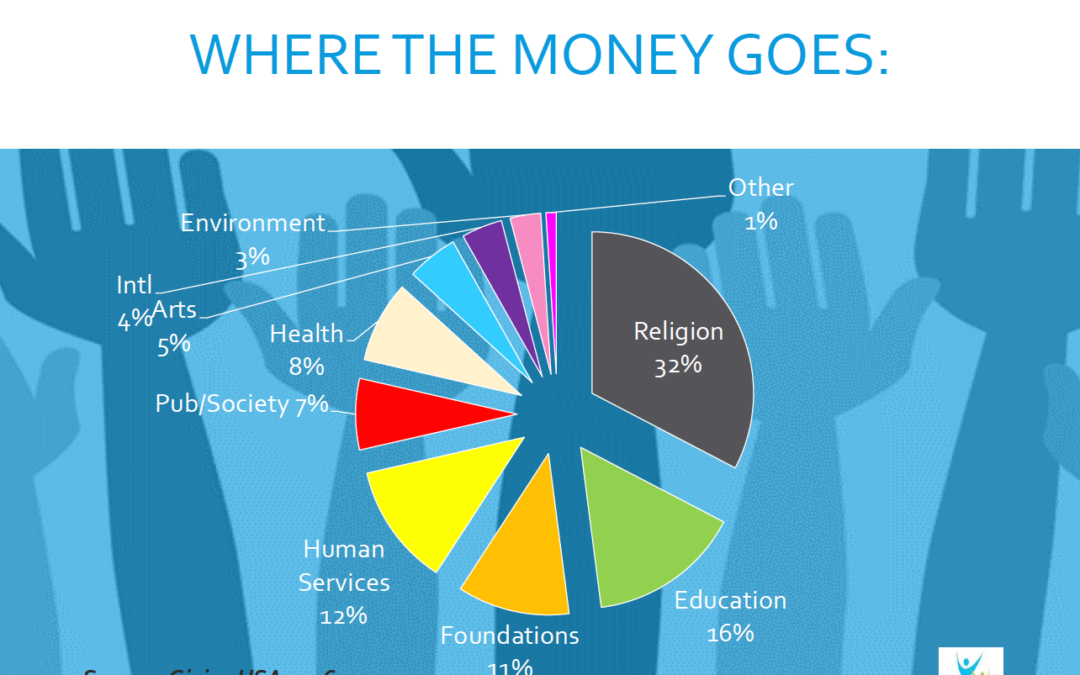

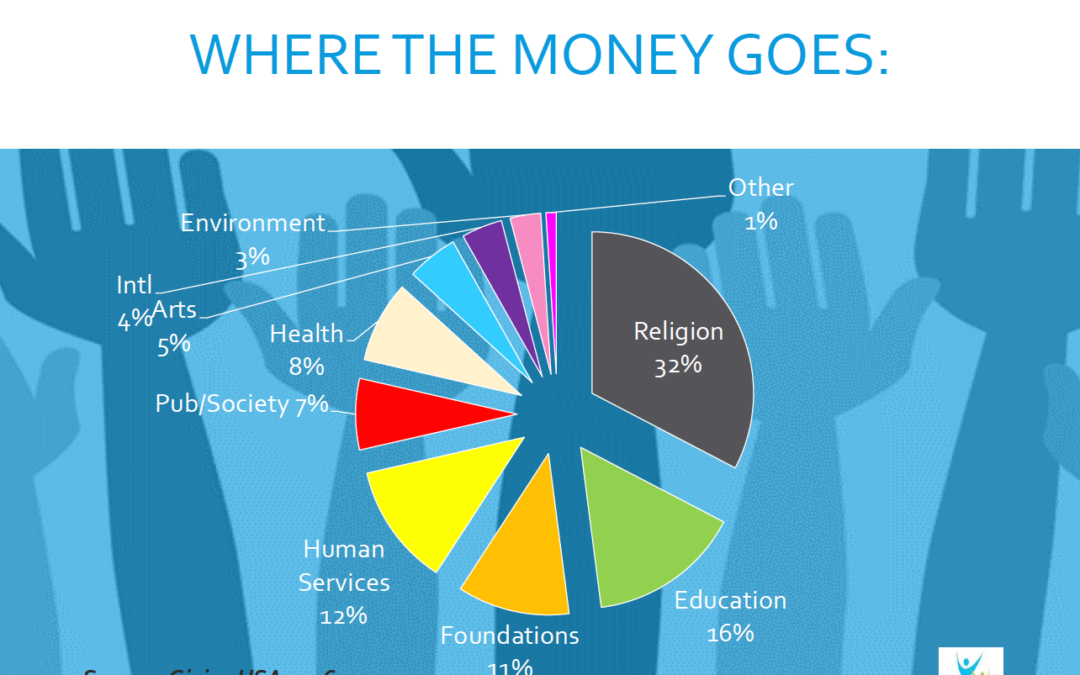

In our ongoing effort to help make planned giving more accessible, collaborative and beneficial for charities, we hosted a workshop led by fundraising expert Laura Kaufman. The fourth in our series of free seminars and workshops, Engaging Your Donors for Life-Long Giving, invited Chicago-area nonprofits to learn about strategies and tactics for engaging donors over a long time horizon. Laura covered three major areas with us: The Individual Donor (ID) Marketplace. What is Engagement and Why Does It Matter? Driving Donor Engagement. State of Giving: National and Chicago Area Trends Nonprofits are experiencing more giving than ever before. In each category, numbers are on the rise, year over year. According to Giving USA’s report, giving by bequest is up 2.1%, giving my individuals is up 3.8% and total giving has increased 4.4%. The next question is, where is the money going? This chart from Giving USA breaks it down nicely. Drilling down to the specific Chicago area market, the Chicago Community Trust shared some interesting data. Compared to a national average of 59%, 73% of Chicagoans give to charity. 49% of Chicago households volunteer and 78% of dollars donated by Chicagoans stay in the region. What is Engagement: Often overlooked, donor engagement is absolutely critical for the long-term health of an organization. While nonprofit fundraisers are busy managing many initiatives for their organization, donor engagement must be the core of their day-to-day. Research shows doing so will make capital and annual giving campaigns go more smoothly, netting better results. The donor engagement cycle can be broken down into these simple components: Recruit/Inspire, Learn, Engage, Ask, Thank, Repeat, Upgrade and...

by Andrew Hibel | Mar 20, 2017 | Charitable Giving, Donor-Advised Funds, Featured |

On May 30, 1985, I skipped high school. No, it was not senior skip day, nor did I really desire a break from school. I wanted to travel from Appleton to Oshkosh to see President Reagan speak. He had just introduced his plan on what would eventually become the Tax Reform Act of 1986 and first went to Wisconsin to sell it to the American people. Contrary to my parents wishes, I did hear the speech in person and watched the ensuing process that produced the new tax code. It was something that sparked my interest in learning about taxes and how (and why) they work the way they do. In law school, my intellectual curiosity about taxes turned towards the charitable deduction and was one of the major factors that drove me to pursue a career in charitable gift planning. I fell in love with the fact that our country effectively allowed citizens to choose where their tax dollars could make a difference. Over the years, my admiration has grown into awe as I have participated in conversations about the deduction that sparked amazing charitable gifts changing the course, and even saving, countless lives. My awe of and now concern about the charitable deduction led me to go to Capital Hill on February 16th where I joined nearly 200 nonprofit leaders in a whirlwind day of meetings hosted by the Charitable Giving Coalition (@ProtectGiving). We visited 130 House of Representatives and Senate offices, including 23 members of the Senate Finance Committee and 26 members of the House Ways and Means Committee. The goal of these meetings was to...

by Andrew Hibel | Nov 22, 2016 | #GivingTuesday, Charitable Giving, Donor Impact, Donor-Advised Funds, Featured |

Giving Tuesday was started in 2012 in a partnership by the 92nd Street Y and the United Nations Foundation to create an international day of giving during the busy holiday shopping season. Since 2012, Giving Tuesday (#GivingTuesday) has become a powerful movement supporting giving and creating a culture of philanthropy. Since its inception, charities have seen large increases in both donor participation and dollars given per-donation. In 2015, charities saw a 155% increase in donations over 2014, bringing in over $117 million dollars. While that represents only a fraction of annual giving to charities, it does represent the largest single day of online giving. Giving Tuesday is helping charities increase the number of donors and reach the increasingly important millennial generation. The social nature of giving on Giving Tuesday makes it a great way to introduce charitable giving to children and teens. So, this coming Giving Tuesday, November 29, 2016, take a moment to give to your favorite charities. If you have the money to spare, start up a donor-advised fund. It makes giving easy, it makes doing your taxes easier without the need to keep track of various tax receipt letters, and it forces you to think about how much you want to give in total, rather than to any given recipient. The Advise Us Fund is itself a 501(c)3 non-profit and you can donate to us here or contact our...

by Andrew Hibel | Aug 29, 2016 | Featured, Linked In |

Being a middle-aged man with a family, my wife and I have been reviewing our estate plans with the intention of revising them. 15 years ago, our attorney-led us through a relatively simple process. This time, I am searching for an app to help me manage the process. An app that will give us what we need to do if we plug in answers to a few multiple choice questions. Unfortunately, this app does not exist and I was stuck for a while trying to find out the status of our plans. In lieu a magical app, I have found the following helped me to break the cycle of procrastination in estate planning: Review and Assemble Current Documents – This may seem simple but this can be complex with wills, trusts, retirement plans and life insurance. Make sure you know where everything is and what is in it. A good summary can be found on RetiredBrains.com. Take a Current Inventory of All Assets – Simply put, in the worst case scenario, it is important to let people know where things are. The inventory should also be a part of your documents. RetiredBrains.com also has a great checklist for items to include. Think of The Important People – We live our lives with and, in many ways, for our loved ones. If you look at the wallpaper of my smartphone, you will see a picture of my loved ones. I’m sure your loved ones occupy similar spaces and you may want them to occupy similar spaces in your estate plans. Think of The Values You Want to Pass On—We donate...

by Rosalyn Lambert | Jul 28, 2015 | Donor-Advised Funds, Featured |

Recurring gifts are nothing new. Numerous nonprofit organizations have shown big results with recurring gift donors. One study of online contributions found recurring gift donors gave 42 percent more annually than one-time contributors. But there is a problem – and an opportunity. One of the biggest areas of donation growth is donor-advised funds. But donor-advised fund advisors – the people you will need to solicit for a donation – cannot make a legally binding pledge using their fund. The advisors can only make “grant advisements.” This is an important legal restriction. But here’s a secret. Most donor-advised fund administrators fulfill almost all advisor grant advisements. That is, charities get the grant. Likely less than one percent of advisements get rejected. The few grant advisements going unfilled are almost always because: The donor requests a grant going to a nonprofit that isn’t a 501(c)3 charity; The donor is receiving something of value for the donation; or, in rare cases, The administrator has restrictions on what 501(c)3 charities can be supported (something donors would be made aware of when they create the fund). If you’re a 501(c)3 charity in good standing with the IRS and do not give anything of value in return for the donation, you should almost always get the grant. Where is the opportunity? Most donor-advised funds offer grant advisement pre-scheduling of recurring donations. This is a growing area with increasing numbers of scheduled contributions. It’s a big opportunity for you! Successfully Solicit Donor-Advised Fund Recurring Grants As you design your donor-advised fund recurring grant campaign there are three considerations (among standard ones) to keep top of mind....