In my life as a development officer I hated donor-advised funds. I felt they took money from my mission, made me miss out on my goals and just made things difficult. Who were these people with their funds – and how could I find them?

As donor-advised funds have grown more popular – and I have become more familiar with them – I’ve moved from respect to real appreciation. I see donor-advised funds in an entirely new light because I better understand their important role – and potential – in charitable giving.

Let’s address common criticisms first.

Common Criticisms

Money (That’s What I Want)

I agree donor-advised funds seem like a charitable bank account or just a financial tool that saves taxes. But the overall annual rate of donor-advised fund contributions – the “payout rate” to charity – regularly exceeds the payout from private foundations. Sometimes the donor-advised fund payout rate is more than double the amount that private foundations donate with their 5% minimum.

Waiting on a Friend

If your concern is waiting for the money, then you should know in practice donor-advised funds compare favorably with many types of charitable giving vehicles, including private foundations, charitable remainder trusts and charitable lead trusts. In fact, many donor advised funds – including The Advise Us Fund – have rules that require donors to make advisements at least annually.

Good Times Bad Times

When it comes to tough financial times, think of donor-advised funds as deep pockets that keep our nonprofit missions motoring. In fact, donors often give more to donor-advised funds when they have an economic windfall, like a business sale or the appreciation of financial securities. These funds gifted during the “good years” are often available to support nonprofits in good times and bad times. Because of their ease and flexibility of use, in some cases donor-advised funds are even superior to other giving techniques during tougher times.

Times are still very tough for many charities – particularly small- to medium-sized ones. And, there is no doubt that recent crises such as the Ebola epidemic in Africa highlight the need for more funding resources. Thankfully as markets have hit record highs so have gifts to donor-advised funds and – importantly – grants from them to charitable organizations in need. Regardless of the need or timing of a crisis, donor-advised funds can often serve to shore up nonprofits.

Who Are You?

What about the “anonymous” gifting factor? At Fidelity Charitable, the largest administrator of donor-advised funds with over 63,000 donor-advised funds in 2013, greater than 9 in 10 grants included names and addresses for nonprofits to send acknowledgements.

At Vanguard Charitable, another large donor-advised fund, from 2004 – 2013 only 5% of grants were anonymous. Vanguard also found that 73% of their donor-advised fund holders report getting involved with charities they donate to beyond their financial gift.

So who are these donors? They are our donors at our charity – not Fidelity’s, or Vanguard’s, or The Advise Us Fund’s, or any other donor-advised fund administrator. As development officers we already have our donors names and addresses, and we are responsible for their cultivation and stewardship. You can succeed more by working with the donors you already know and cultivate at your nonprofit organization than worrying about those “other” donor-advised fund dollars.

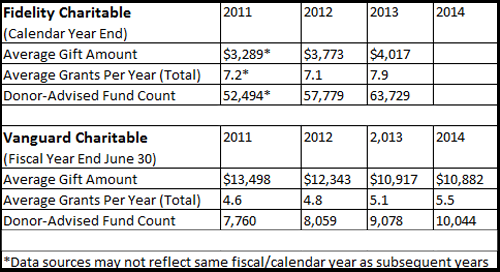

What about the positives for donor-advised funds? Let’s talk in language development officers appreciate with data from two of the largest donor-advised funds.

What’s Good About Donor-Advised Funds?

-

Unrestricted Gifts. From 2008-2012 the percentage of unrestricted gifts at Fidelity Charitable climbed steadily from 37% to 42% and in 2013 was still strong at 41% (over 212,000 grants). At Vanguard Charitable from 2004 – 2013 63% of grants were unrestricted – a strong majority – with 62% in fiscal year 2014 similarly designated (34,000). That’s a lot of unrestricted grant funding!

-

Pre-Scheduled Gifts. From 2008 – 2012 the percentage of grants that were scheduled gifts at Fidelity Charitable climbed steadily from 16.8% to 21.2% – or more than one in five – representing hundreds of thousands of grants.

-

Giving More. The ease and convenience of donor-advised funds also seems to encourage giving. At Fidelity Charitable annual surveys consistently find that two-thirds of donors report giving more because they use a donor-advised fund. Donor-advised funds are also more asset- and tax-efficient, offering greater potential for charitable gifts.

-

Unlike private foundations and charitable trusts, donor-advised funds are low-cost for donors to start and maintain, which means more of their charitable gifts actually go to charity.

-

The relatively high use of appreciated asset gifts by donor-advised fund holders also means that more money is set aside for charity than would likely be the case with “checkbook” or cash donations – with donors using “two step” tax advantages to increase their giving potential.

-

Charting the Numbers

Get Beyond Just “Used to” Donor-Advised Funds

Donor-advised funds are here to stay – and that’s a good thing. With high actual payout rates compared to private foundations and other charitable vehicles, donor-advised funds have been wrongly maligned. I think that’s in part because many donor-advised funds have grants advised by mid-level “middle” donors – and “they don’t get no respect.” Major donors with major gifts are wined and dined. Small donors get constant contact with email, direct mail and modest gifts.

What about middle donors?

Middle donors making annual gifts totaling $1,000 to $10,000 represent more than a third of donor dollars – but few nonprofits have staff or resources focused on them. Yet many of these middle donors are the same demographics as people who have donor-advised funds.

Think about it. Few charities focus on middle donors. Middle donors include many of the types of donors that have donor-advised funds. Maybe that’s an answer to the problem of “why nobody knows who has a donor-advised fund.”

Get “Great” with Donor-Advised Funds Using a Four-Step System

Donor-advised funds are – or can be – your organization’s bread-and-butter! Think about using a more positive approach with a four-step donor-advised fund system.

Step One: Discover. You’ve already started the first step by discovering the positive sides of donor-advised giving. Now encourage your donors to explore how donor-advised funds can benefit them. Highlighting positive news and examples of donors using donor-advised funds in your organization’s communications can help you identify middle and major donors that either have (or would benefit from) donor-advised funds.

Step Two: Approach. Once you have found donors using (or seriously considering) donor-advised funds start recognizing them for who they are – donors that can represent a huge amount of your donor dollars. Some of these middle and major donors may not be people that you thought had the capacity and interest to offer your organization larger gifts.

Consider better ways to manage your donor relationships. For existing middle donor relationships, if you don’t already have an approach for them, develop one. Approach newly “re-discovered” donors capable of moving to middle and major donor levels to develop appropriate, stronger and more beneficial relationships with them.

Step Three: Funding. Cultivate your prospects, steward your donors and know that when the right donor meets the right cause, there may be money waiting for just that moment. A major benefit of donor-advised funds is that they can offer charitable giving resiliency even in a poor economic climate. Whatever money is in a donor-advised fund is dedicated to charity – and your relationship can make a difference.

Step Four: Scheduling. Remember that donors benefit from the ease-of-use and flexibility of a donor-advised fund – and your charity can too! Scheduling donations with a donor-advised fund is easy and doesn’t require reminders to a donor or donor actions at “just that time” – all it requires is one easy advanced advisement from the donor. The donor-advised fund administrator handles the rest automatically.

Offer programs that encourage using donor-advised funds to schedule regular donations at critical funding junctures for your nonprofit. These programs can mean a substantial funding boost just when your charity needs it most!

The four-step donor-advised fund system can move you from being just “used to” donor-advised funds to getting “great” with them. Establish your relationships, unlock the potential and help make your donor-advised fund experience a great one for your donors and your organization.

____________

Rosalyn Lambert serves as Charitable Catalyst, Donor Services, at The Advise Us Fund. She first experienced philanthropy as a 5th grade volunteer at the Red Cross, and later would work as General Manger, Financial Development at the Red Cross. An independent fundraising consultant, Roz has worked as a Senior Development Officer in Pediatrics at the University of Chicago; Manager of Major Gifts, Lutheran General Hospital, at the Advocate Charitable Foundation; and worked as Assistant Director of Corporate Relations at the Chicago Zoological Society. Roz holds a B.A. in Philanthropy and Fundraising at Indiana University Bloomington.

The information in this blog post is general and educational. It is not intended nor should it be construed as legal, tax, investing or financial advice. Individuals should consult with their own advisor about charitable giving arrangements The Advise Us Fund® may describe.