by Amy Roy | Oct 15, 2019 | Charitable Giving, Donor Impact, Featured, Linked In |

Catalyst: (noun) A person or thing that precipitates an event. The Advise Us Foundation is a nonprofit working as a catalyst to philanthropic giving for individuals and fellow nonprofits. As an organization that advances philanthropy, Advise Us is helping to change the world we live in by catalyzing donors’ intentions into support of non-profits’ important missions. From its earliest days, Advise Us has offered donor-advised fund giving to individuals to help them plan their philanthropic donations and legacies while at the same time take advantage of tax incentives that maximize philanthropic impact. Individuals are able to create or add to a charitable fund based on when it is a good time for them to give. They, in turn, can grant money out from their fund as donations to nonprofit organizations at any time they wish. Through the inspired generosity of those taking advantage of this charitable giving tool, the Advise Us Foundation has granted gifts to numerous organizations from the smallest start-ups to large educational institutions. Advise Us is also a catalyst for other charitable organizations by enabling them to create and use expanded giving options for their donors. The staff and volunteers of Advise Us have collectively decades of fundraising experience with a concentration on planned giving. Working in partnership with organizations to offer hands-on tactical advise and services affords these organizations the ability to increase their fundraising capabilities thereby increasing their mission-based impact for generations to come. The Advise Us Foundation also offers other means of direct support to the charitable community through educational seminars. With a special focus on small and medium-sized charities, our free educational...

by Andrew Hibel | Apr 2, 2019 | Featured, Linked In |

It’s Sunday afternoon and I’ve just driven three hours through the frozen heartland of Illinois to pay my last respects to someone who has recently passed away. It is sunny on what should be a dark day, but my drive has given me the opportunity to reflect on my 30 plus year relationship with the family that I am about to visit. This day, unlike so many others I have shared with the family, will be a sad one. I must say goodbye to someone who has shared his generosity and wisdom with me and has left an indelible mark on my life. It has been a privilege to be present in the life of this family and, now, in the passing of their loved one. This privilege is not lost on me. As a planned giving officer, I get to serve as a conduit and catalyst for the amazing philanthropic endeavors of those with whom I work. In doing so, I get to connect with incredible people and benefit immeasurably from their giving, not only as I gain a deeper understanding of their giving goals but also the fabric of life that holds us all together. Nonprofits do an excellent job of promoting how planned gifts, and their donors, achieve amazing results in saving and changing the lives of the recipients of philanthropic gifting. While planned gifts are often associated with tax planning, they still come with a story. There is a nature behind planned givers better seen as givers who are thoughtful about how their lives can touch the lives of others through their acts. Those who...

by Andrew Hibel | Dec 13, 2018 | Charitable Giving, Donor Impact, Featured, Linked In, Taxes |

The Tax Cuts and Jobs Act of 2017 was the first major legislative change to the tax code since 1986. While many of its’ changes left how the charitable deduction worked unchanged, the doubling of the standard deduction is predicted to reduce the percentage of taxpayers who itemize from 30% to 10% which effectively removes two-thirds of taxpayers who could have used the charitable deduction in 2017. This reduction has made many taxpayers in 2018 to ask the question of whether to itemize or not itemize their deductions. The good news is that there are still great taxwise ways to give to charity, either way, you answer that question. Idea to consider if you don’t itemize- gift from your IRA If you are 70 ½, you are able to make a charitable contribution, up to $100,000, to a public charity of your IRA and not incur the distribution as taxable income. You are not able to deduct the amount as a charitable contribution (but you would not be able to anyway as you are not itemizing your deductions) nor can you contribute it to a donor advised or a private foundation. Please know that these are just the basic details and you will need to discuss this technique with your advisor before implementing. And good minds differon the value of this strategy. Idea to consider if you do itemize- bunching a gift to a donor advised fund If you are going to itemize your deductions this year, and might not do so next year, then you should consider a donor advised fund(DAF). With a DAF, you are able to claim...

by Amy Roy | Oct 11, 2018 | Charitable Giving, Featured, Foundations, Linked In |

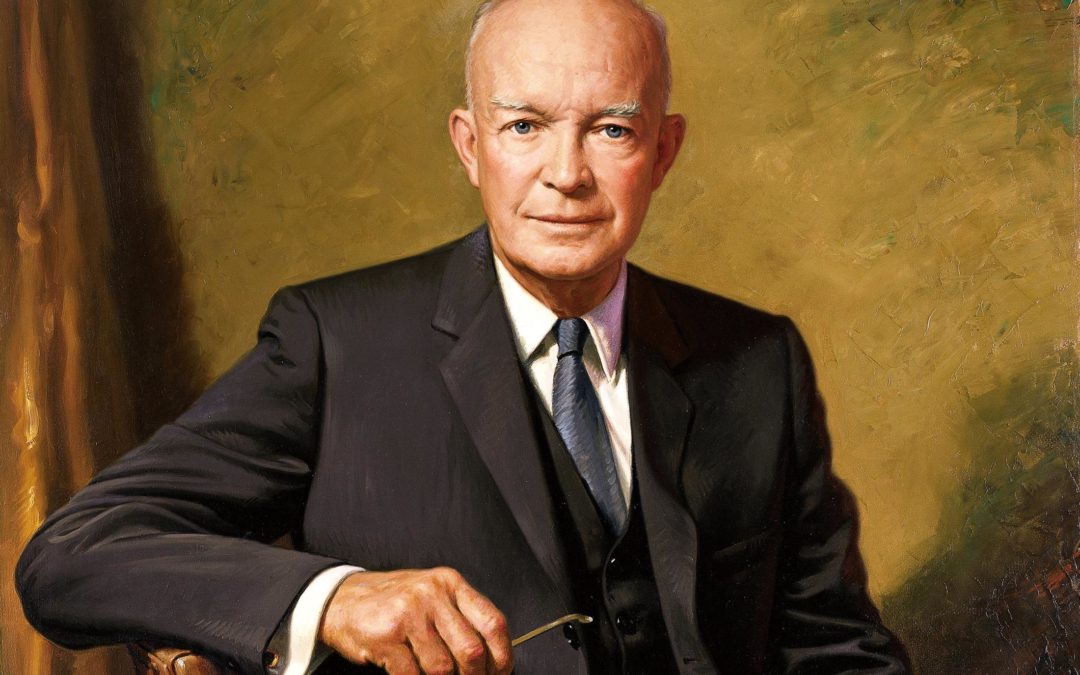

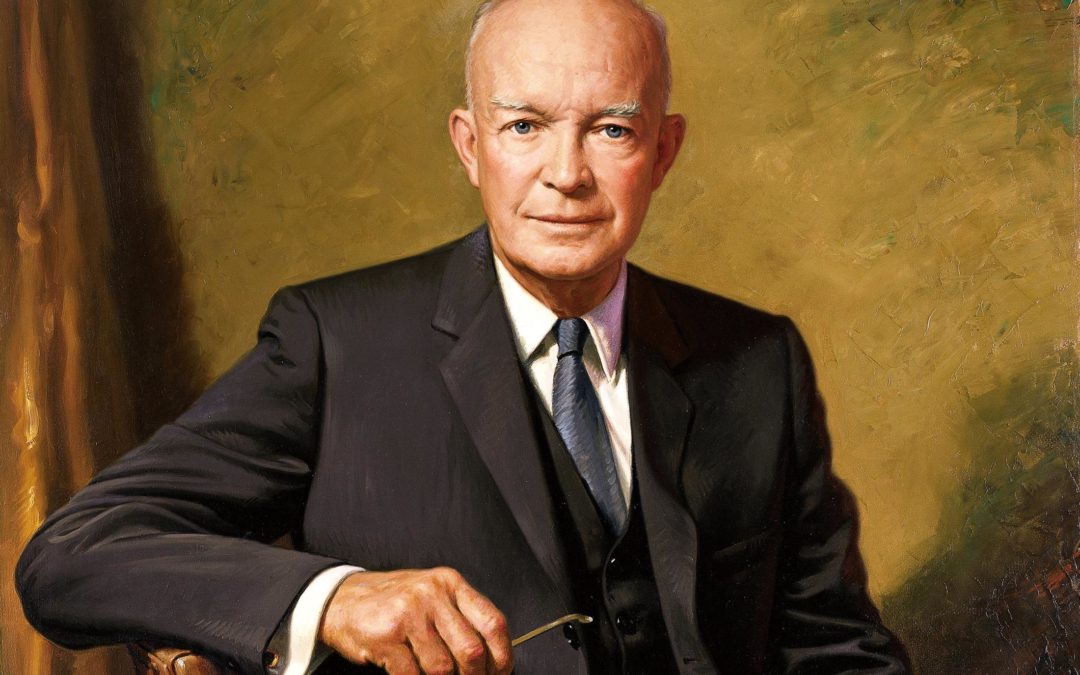

“Plans are nothing; planning is everything.” Dwight D. Eisenhower A little planning can go a long way. Did you know that making a planned gift will not only help ensure the health of the organizations you support long into the future but can also provide benefits to you? What exactly is planned giving? And, how can you benefit from it? In short, a planned gift is the type of gift that requires a little more thought than simply writing a check or processing a credit card. It’s a gift, as the name implies, that you’ve planned for – you’ve given consideration about from where and how the gift will be received. The great thing about planned giving is that it allows you to give wisely and take advantage of tax strategies and giving vehicles that provide benefit to you while at the same time maximize the amount of charitable dollars that can benefit an organization. Planned giving can come in many forms and fall under three general categories. Outright gifts: One of the most basic and common is a gift of appreciated stock or securities that allow you to pass on the gains to your favorite organization. Making a charitable gift of appreciated stock that you’ve held for a year or more saves you the tax burden as you avoid realizing the capital gains, yet still allows you to deduct the current value of the stock if you itemize. Gifts that return income: Other types of planned gifts can be set up to provide a stream of income either to you or the organization you choose to support. ...

by Robert Freedman | Sep 12, 2018 | Charitable Giving, Donor-Advised Funds, Featured, Foundations, Linked In |

Antioch, Sep 11, 2018 (Issuewire.com) – The RainShine Foundation (RainShine), a 501(c)3 nonprofit organization dedicated to supporting remote Congolese communities, is proud to announce the launch of its donor-advised fund, the RainShine Donor-Advised Fund. RainShine has entered into a partnership with the Advise Us Foundation, a national public charity dedicated to making the processes of donor-advised and planned giving more accessible, collaborative and beneficial for charities, donors, and their advisers. Through a generous, anonymous gift, the RainShine donor-advised fund enables the organization to build up financial reserves and plan for long-term capital improvement projects. Through its charitable giving partner, Advise Us Foundation, RainShine supporters can contribute a wide range of assets to RainShine’s donor-advised fund, including cash, appreciated stock, bonds, mutual funds, restricted and closely-held or non-publicly traded securities, real estate, limited partnerships, deferred gifts, and other illiquid assets. Assets in the donor-advised fund grow tax-free. “The decision for RainShine to partner with the Advise Us Foundation was simple. We were seeking a like-minded organization that was small enough to listen to our unique needs but also big enough to provide the charitable giving guidance we need now and into the future,” said Rob Freedman, Founder and Managing Director of The RainShine Foundation. This partnership will help ensure RainShine’s work building schools and other community infrastructure can continue and eventually expand to other villages in the Bas-Uele region of the Democratic Republic of the Congo. For far too long, this region of the Congo has been underserved by both the Congolese government and international NGOs alike. RainShine stands as the only international organization working to help the people of Epi achieve...