by Hiram Wurf | Jun 26, 2015 | Donor Impact, Donor-Advised Funds, Linked In |

Trend – more donors scheduling donor-advised fund contributions to #charity.

by Hiram Wurf | Jun 26, 2015 | Donor-Advised Funds, Linked In |

Do you want a great opening day for your donor-advised fund? Cover these four bases

by Hiram Wurf | Jun 26, 2015 | Donor Intent, Donor-Advised Funds, Featured |

More donors are taking advantage of scheduling donor-advised fund contributions to charity. Recent data from Fidelity Charitable, the largest donor-advised fund administrator, shows an increase of six percent over the six years from 2008 – 2014. What are the donor benefits to scheduling donor-advised fund gifts to charity? Here are three: 1. Make the Gift Schedule When It’s Right for You. If planning gifts during the Thanksgiving/Winter Holiday season is too hectic, then donor-advised fund scheduling lets you plan ahead when you have the time. 2. Give Charitable Gifts When It’s Right for You. Scheduling with a donor-advised fund offers you the opportunity to plan your gifts better – include all the charities you support and give them gifts at the time that is right for you. 3. Budget for Your Charitable Giving Better. You can plan your budget easier when you schedule your gifts ahead of time. You also can distribute “windfall” funds – from sale of a business, a salary bonus or a high valuation of appreciated securities – more thoughtfully and easily with scheduled giving from your donor-advised fund. More Donors See Advantages of Donor-Advised Fund Scheduled Contributions Donors recognize the convenience of planning ahead when they have the time. It’s a great charitable giving advantage! Scheduling donations works best when the gifts are “predictable” in amount and timing. Donor-advised fund gift scheduling can make your charitable giving process much easier and better. ____________ Hiram Wurf is Charitable Catalyst, Managing Director of The Advise Us Fund®. The Advise Us Fund is an independent 501(c)3 nonprofit organization that offers a donor-centric approach to charitable giving. Hiram formerly...

by Hiram Wurf | Jun 9, 2015 | Donor Intent, Donor-Advised Funds, Featured |

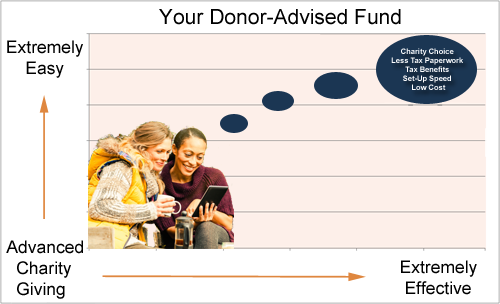

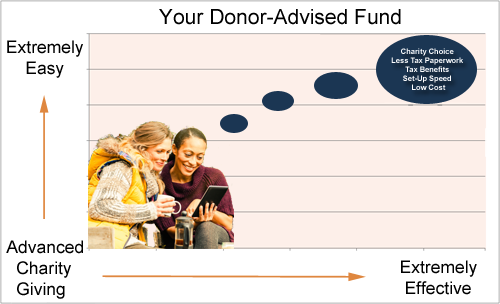

We’re big fans of donor-advised funds because they offer donors an easy and effective charitable experience. Donor-advised funds give you a great tool that lets you focus on the joys of charitable giving. 5 Easy and Effective Contributions to Your Charity Experience Here are five benefits donor-advised funds bring to your charitable experience. 1. Charity Choice – You have a lot of options. Donor-advised funds let you donate to 501(c)3 public charities – giving you over 1 million choices, including most well-known (and many lesser-known) nonprofit organizations. 2. Less Tax Paperwork – Don’t like paperwork? No problem! Donor-advised fund sponsors handle almost everything. You just keep receipts from your tax deductible contributions to your fund for your personal tax filings. 3. Tax Benefits – Ready for a less taxing experience? You can save more, give easier and give better with these donor-advised fund tax advantages. 4. Set-Up Speed – It’s fast! Fill out the application and send it in with your contribution. It’s really that simple. Your donor-advised fund sponsor will process your application and you’ll be ready to start engaging in smarter philanthropy. 5. Low Cost – Donor-advised funds don’t cost much at all. Compared to many other advanced charitable giving vehicles – such as foundations and trusts – donor-advised funds offer tremendous value. With only modest administrative and investment fees you avoid legal and accounting fees that other vehicles require. This means more of your money goes where you want it to go – to charity. Great Charitable Opportunity for Donors Donor-advised funds offer donors an opportunity to make their charitable giving better. The ease and efficiency...

by Rosalyn Lambert | Apr 22, 2015 | Charitable Remainder Trust, Donor Intent, Donor-Advised Funds, Featured |

Bequests are the third highest source of income for charity totaling $28 billion in 2013. While big bequests going to big nonprofits may make news, the average bequest is between $35,000 and $75,000 according to 2011 research by Blackbaud, Inc.* That’s funding that can make a big difference for a small- or mid-sized charity’s mission – especially when numerous donors give. While any charity can receive a bequest – smart charities try to improve their chances. Why? Because becoming a bequest successor is a real commitment from your donor –a vote of confidence in your mission. Financially it funds your mission now and later. Most people understand eventual bequest funding, but fewer understand what it means now. Donors who make bequest commitments average more than double the annual gifts of other donors. Even donors just considering a bequest give over 25% more annually than those who aren’t considering a bequest. As Emily Krauser points out in her groundbreaking research “For a fund raiser, being named in a donor’s will is a great way to build lifetime commitment to an organization. Increasing the number of individuals with a charity named in their wills not only will increase the future dollar amount given by bequest, but may also increase donor loyalty and inter-vivos giving [i.e. giving during the donor’s lifetime].” Bequest donors are among your most important donors – or they can be, if you cultivate them. Read on for ways you can improve your bequest program. [If you don’t have a bequest program it’s easy to start one and we can help (contact us) – it’s part of our charitable...