by Rosalyn Lambert | Jan 13, 2015 | Donor Intent, Donor-Advised Funds, Featured |

In my life as a development officer I hated donor-advised funds. I felt they took money from my mission, made me miss out on my goals and just made things difficult. Who were these people with their funds – and how could I find them? As donor-advised funds have grown more popular – and I have become more familiar with them – I’ve moved from respect to real appreciation. I see donor-advised funds in an entirely new light because I better understand their important role – and potential – in charitable giving. Let’s address common criticisms first. Common Criticisms Money (That’s What I Want) I agree donor-advised funds seem like a charitable bank account or just a financial tool that saves taxes. But the overall annual rate of donor-advised fund contributions – the “payout rate” to charity – regularly exceeds the payout from private foundations. Sometimes the donor-advised fund payout rate is more than double the amount that private foundations donate with their 5% minimum. Waiting on a Friend If your concern is waiting for the money, then you should know in practice donor-advised funds compare favorably with many types of charitable giving vehicles, including private foundations, charitable remainder trusts and charitable lead trusts. In fact, many donor advised funds – including The Advise Us Fund – have rules that require donors to make advisements at least annually. Good Times Bad Times When it comes to tough financial times, think of donor-advised funds as deep pockets that keep our nonprofit missions motoring. In fact, donors often give more to donor-advised funds when they have an economic windfall, like a...

by Hiram Wurf | Nov 17, 2014 | Donor-Advised Funds, Featured |

E.W. Scripps Co. Chair, President & CEO Rich Boehne seeks a $1M donor-advised fund in his name as employment compensation. Boehne describes the effort as a ‘partnership’ to further align the company’s and his ideals, “The Scripps Howard Foundation’s commitment to the future of journalism and to the well-being of the communities we serve makes it a vital partner for both the company and individuals – like me – who share the same values and passions.” It sounds like the charitable equivalent of using stock options to align company shareholder and executive interest. But the spirit seems quite different. In this case it’s aligning the company and its executive around philanthropy, with charitable beneficiaries as major stakeholders. Using a donor-advised fund to align corporate and management philanthropic interests could be a future trend for executive compensation. Already an old story among investment banks with their own foundations and donor-advised funds, Rich Boehne’s efforts could signal a move in companies with more diverse business interests. Boehne himself is no stranger to donor-advised funds. He has had a family donor-advised fund for at least 13 years. ____________ Hiram Wurf is Charitable Catalyst, Managing Director of The Advise Us Fund®. The Advise Us Fund is an independent 501(c)3 nonprofit organization that offers a donor-centric approach to charitable giving. Hiram formerly served as Executive Director and Founder of the nonprofit 12 State, Inc. and as Marketing Communications Manager for Cool Choices, Inc. He has more than 16 years experience in nonprofit development, marketing and communications including nine years administering grants at a family foundation. The information in this blog post is general and...

by Andrew Hibel | Oct 21, 2014 | Donor-Advised Funds, Featured, Foundations |

This year the Chronicle of Philanthropy revealed the “50 Most Generous Donors of 2013.” While many donors on the list donated to private foundations, the donor couple topping the list with the most charitable giving, Facebook’s Mark Zuckerberg and his wife Priscilla Chan, gave their gift to a donor-advised fund. This was the first time a donor-advised fund was the top charitable recipient for living donors. Fifth on the list were John and Laura Arnold, who use a donor-advised fund in addition to a more traditional foundation. Similarly Pierre and Pam Omidyar, seventh on the list, use donor-advised funds in addition to foundations and social impact funds for their charitable giving. The biggest donors in America may be using donor-advised funds – but they aren’t the only ones. Donor-Advised Funds vs. Private Foundations – Numbers and Trends Over the past century, many large private foundations, like the Bill and Melinda Gates Foundation, have made transformative gifts making an impact throughout the world. But while the biggest foundations often get the most notice, two-thirds of the 86,000 private foundations in existence have less than $1 million in assets. Nor are most foundation as old as most people think – sixty-percent of foundations were formed within the past 15 years – and forty-percent in the last decade. These are big numbers – over 34,000 foundations formed in the last ten years – and foundations are the right charitable vehicle for many donors. But they are being surpassed by a “user-friendly” charitable vehicle that’s lower cost, “faster” and more direct for many donors – the donor-advised fund. Over just the last five...

by Andrew Hibel | Sep 23, 2014 | Donor-Advised Funds, Featured |

Donating stock to charity is often the best method of charitable giving – but timing makes a difference! You want to give your stock at the right time for you and donate at the right time for you – and those times are often different. When is the Right Time to Make Your Stock Gift? Gifting appreciated stock that you have owned for more than a year should permit you to gain the current fair market value of the stock while not paying capital gains tax. Your stock donation may also receive a charitable income tax deduction of up to 30% of adjusted gross income of the appreciated stock value. The best time to donate appreciated stock is when its value is high and the timing is right for you financially. But what if that timing isn’t the “right” time to donate to the charity or charities you’re passionate about? Read on…. When is the Right Time to Donate to Charity? While tax and stock value advantages are important, many donors believe that the best part of donating to charity is the ability to make a difference in the charitable causes we believe in. People often have a time of year or an inspiration that spurs the charitable giving process. These catalysts make our giving more meaningful – we treasure them. You should give when it’s right for you. You should give on the holidays and occasions where and when you would normally give. You should give when a close friend shares a story about an incredible cause where you can make a real difference. You should give whenever...

by Hiram Wurf | Sep 3, 2014 | Donor-Advised Funds, Featured |

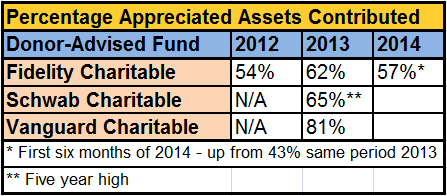

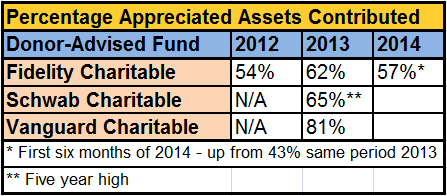

Trending with the growth of financial markets (some at record highs) donors are increasingly giving gifts to donor-advised funds of appreciated assets including stocks, bonds, and more complex assets in publicly and privately held companies. Among the three largest donor-advised funds Fidelity Charitable Gift Fund and Schwab Charitable Fund both saw year-over-year growth in appreciated asset gifts – with Fidelity continuing to increase the percentage of appreciated asset gifts the first half of this year. Donors to Vanguard Charitable Endowment Program dramatically reversed their gifting patterns from providing “a lion’s share” of cash gifts in 2011 to providing 81% of 2013 gifts in appreciated securities. All those appreciated assets really added up! In 2013 donors to Fidelity Charitable’s donor-advised fund contributed $2.2 billion of appreciated assets to their accounts. Vanguard Charitable donors gifted $730 million in appreciated assets – the bulk of the $904 million they contributed – to its donor-advised fund. With Schwab Charitable added, the total of appreciated assets gifted to the three largest donor-advised funds in 2013 likely exceeds $3.5 billion. ____________ Hiram Wurf is Charitable Catalyst, Managing Director of The Advise Us Fund®. The Advise Us Fund is an independent 501(c)3 nonprofit organization that offers a donor-centric approach to charitable giving. Hiram formerly served as Executive Director and Founder of the nonprofit 12 State, Inc. and as Marketing Communications Manager for Cool Choices, Inc. He has more than 16 years experience in nonprofit development, marketing and communications including nine years administering grants at a family foundation. The information in this blog post is general and educational. It is not intended nor should it be construed...