by Andrew Hibel | Aug 27, 2015 | Donor Intent, Donor-Advised Funds, Featured |

Don’t have time now? Do it later. Something came up and you want to give now? Go ahead. Do you have a foundation or a charitable trust and want additional flexibility? You can have it. Donor-advised funds offer donors like you great options! Giving to Your Donor-Advised Fund and Getting More for Charity You can make a gift to your donor-advised fund when it works for you. Make gifts of appreciated assets, employee bonuses, or proceeds from business sales when it’s most convenient and when you want to take a charitable deduction that year. Donor-advised funds help maximize your donations to charity through favorable tax treatment. You can deduct up to 50% of your adjusted gross income (AGI) for cash gifts and up to 30% of AGI for gifts of appreciated securities held at least a year. That means you can have more money to give to the charities you care most about. Making Grant Advisements to Charity Then you can advise grants. Your options? Give to any of more than one million IRS qualified 501(c)3 charities whenever you want. When can you give to charities? Now and in future years. How can you give? You can give now or schedule your charitable donations. Pre-scheduling one-time or recurring donations with a donor-advised fund is easy, popular and a huge opportunity to save your time! Using Donor-Advised Funds Along with Private Foundations and Charitable Trusts Many people have a donor-advised fund as a compliment to their existing foundation or charitable trust. Donor-advised funds also work well with checkbook giving, estate planning and IRA disbursements. Donor-advised funds can offer greater flexibility...

by Hiram Wurf | Jul 10, 2015 | Donor Intent, Donor-Advised Funds, Featured |

“This whole idea of philanthropy is such a new thing for us. It’s a beautiful situation.” David Marck and his sisters, Roberta and Sarah, learned about their parents’ philanthropic gift “the day of their mother’s funeral.” “We couldn’t believe how much they had contributed,” David said. His parents, local businesspeople and active volunteers in La Crosse, WI, inspired the community focus of the donor-advised fund. The fund, advised by their children, supports free live music events in La Crosse. It also continues their family connection and community legacy. Donors often use donor-advised funds with specific charitable goals and themes in mind. Sometimes the name of the fund describes the cause. Other times donor-advised funds do not describe cause(s) they support in their name, but still have a specific charitable focus. 5 Ways Donor-Advised Fund Flexibility Offers Unique Advantages to Focused Philanthropy Donor-advised funds offer flexibility for donors with specific charitable goals or thematic interests. Here are five ways you can benefit from donor-advised fund flexibility with a philanthropic focus. 1. Flexible Naming. You have almost unlimited naming options for your donor-advised fund. 2. Flexible Charitable Beneficiaries. Donor-advised funds offer donors the right to advise grants to 501(c)3 nonprofit organizations. That means over 1 million well-known and lesser known charity options. These charities benefit a tremendous number of causes with diverse offerings that likely include those you seek to support. 3. Flexible Grant Advisement Decision-Making. Legally advisor(s) listed on a donor-advised fund can make grant advisements. But donors may name as many or as few advisors as they like. Advisors may also, informally, come up with any charitable grant advisement...

by Hiram Wurf | Jun 26, 2015 | Donor Intent, Donor-Advised Funds, Featured |

More donors are taking advantage of scheduling donor-advised fund contributions to charity. Recent data from Fidelity Charitable, the largest donor-advised fund administrator, shows an increase of six percent over the six years from 2008 – 2014. What are the donor benefits to scheduling donor-advised fund gifts to charity? Here are three: 1. Make the Gift Schedule When It’s Right for You. If planning gifts during the Thanksgiving/Winter Holiday season is too hectic, then donor-advised fund scheduling lets you plan ahead when you have the time. 2. Give Charitable Gifts When It’s Right for You. Scheduling with a donor-advised fund offers you the opportunity to plan your gifts better – include all the charities you support and give them gifts at the time that is right for you. 3. Budget for Your Charitable Giving Better. You can plan your budget easier when you schedule your gifts ahead of time. You also can distribute “windfall” funds – from sale of a business, a salary bonus or a high valuation of appreciated securities – more thoughtfully and easily with scheduled giving from your donor-advised fund. More Donors See Advantages of Donor-Advised Fund Scheduled Contributions Donors recognize the convenience of planning ahead when they have the time. It’s a great charitable giving advantage! Scheduling donations works best when the gifts are “predictable” in amount and timing. Donor-advised fund gift scheduling can make your charitable giving process much easier and better. ____________ Hiram Wurf is Charitable Catalyst, Managing Director of The Advise Us Fund®. The Advise Us Fund is an independent 501(c)3 nonprofit organization that offers a donor-centric approach to charitable giving. Hiram formerly...

by Hiram Wurf | Jun 9, 2015 | Donor Intent, Donor-Advised Funds, Featured |

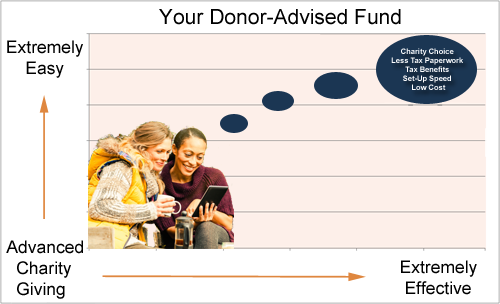

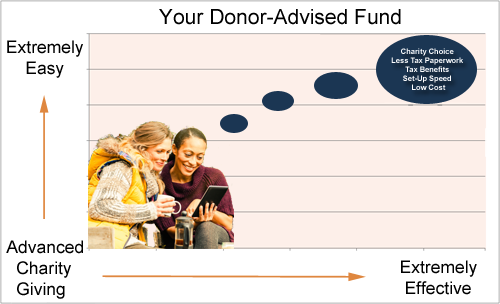

We’re big fans of donor-advised funds because they offer donors an easy and effective charitable experience. Donor-advised funds give you a great tool that lets you focus on the joys of charitable giving. 5 Easy and Effective Contributions to Your Charity Experience Here are five benefits donor-advised funds bring to your charitable experience. 1. Charity Choice – You have a lot of options. Donor-advised funds let you donate to 501(c)3 public charities – giving you over 1 million choices, including most well-known (and many lesser-known) nonprofit organizations. 2. Less Tax Paperwork – Don’t like paperwork? No problem! Donor-advised fund sponsors handle almost everything. You just keep receipts from your tax deductible contributions to your fund for your personal tax filings. 3. Tax Benefits – Ready for a less taxing experience? You can save more, give easier and give better with these donor-advised fund tax advantages. 4. Set-Up Speed – It’s fast! Fill out the application and send it in with your contribution. It’s really that simple. Your donor-advised fund sponsor will process your application and you’ll be ready to start engaging in smarter philanthropy. 5. Low Cost – Donor-advised funds don’t cost much at all. Compared to many other advanced charitable giving vehicles – such as foundations and trusts – donor-advised funds offer tremendous value. With only modest administrative and investment fees you avoid legal and accounting fees that other vehicles require. This means more of your money goes where you want it to go – to charity. Great Charitable Opportunity for Donors Donor-advised funds offer donors an opportunity to make their charitable giving better. The ease and efficiency...

by Andrew Hibel | May 26, 2015 | Donor Impact, Donor Intent, Featured |

Donors give to charity because it “feels good” to give. Usually donors feel good when they believe their contribution “makes a difference.” I know that makes me feel good! But how do you know if your donation makes a difference? There are a number of charity metrics – including defining what success looks like, “on-the-ground” testimonials from those who benefit from donor generosity, and impact reports – that can help donors appreciate how a nonprofit succeeds at its mission. Critically, the process requires organizational management, data collection and analysis, and communicating success with donors. And that costs money. They’re “overhead” costs. Frequently overhead costs come up when assessing charity “worthiness” – and there’s nothing wrong with that. Nonprofit expenses, including overhead, should be in line with good charitable practices. Inflated administrative salaries do not make charity better. But “normal” administrative costs do make nonprofit organizations better. Administrative and development personnel – paid a fair wage – provide critical nonprofit infrastructure. That infrastructure is critical to achieving charitable missions. Charity overhead matters. How should we measure overhead? While we often see overhead listed as a percentage of overall expenses, that alone is a poor measure. Measuring overhead requires context. Start-up and smaller charities may have a higher overhead because of their developmental stage. Some charitable missions may require more administration. For example, organizations with a lot of program staff or volunteers may need more human resources administration. On the flip side, larger charities often have economies of scale that permit them to spend less on overhead. Does that mean that only larger nonprofits can really “make a difference” in their...