by Amy Roy | Jul 10, 2017 | Charitable Giving, Featured, Linked In |

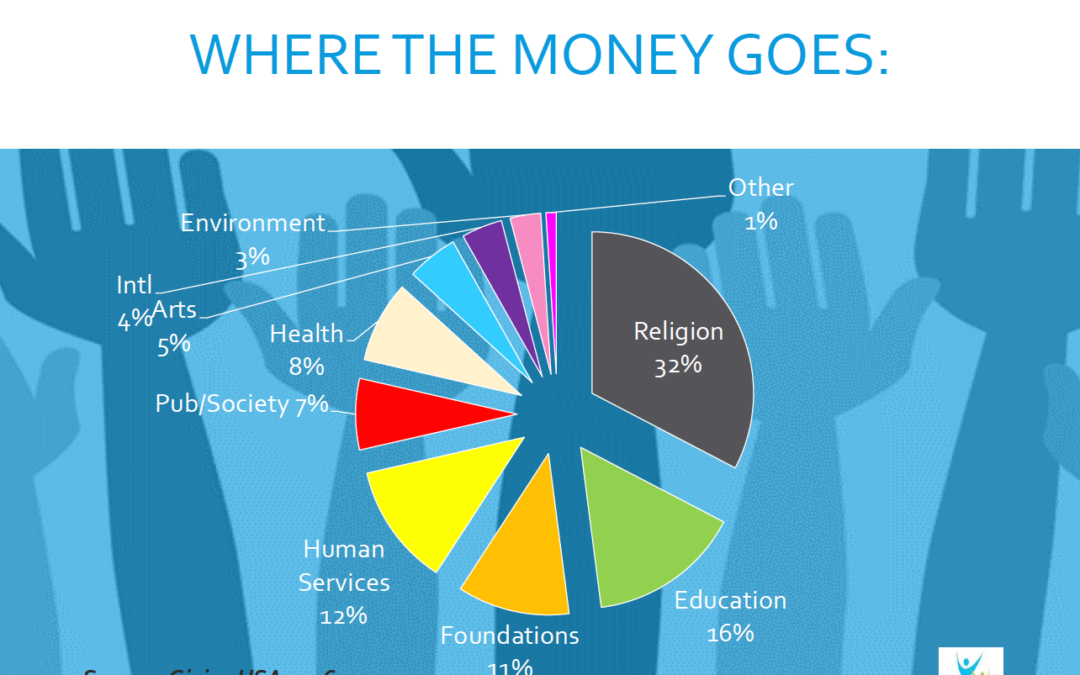

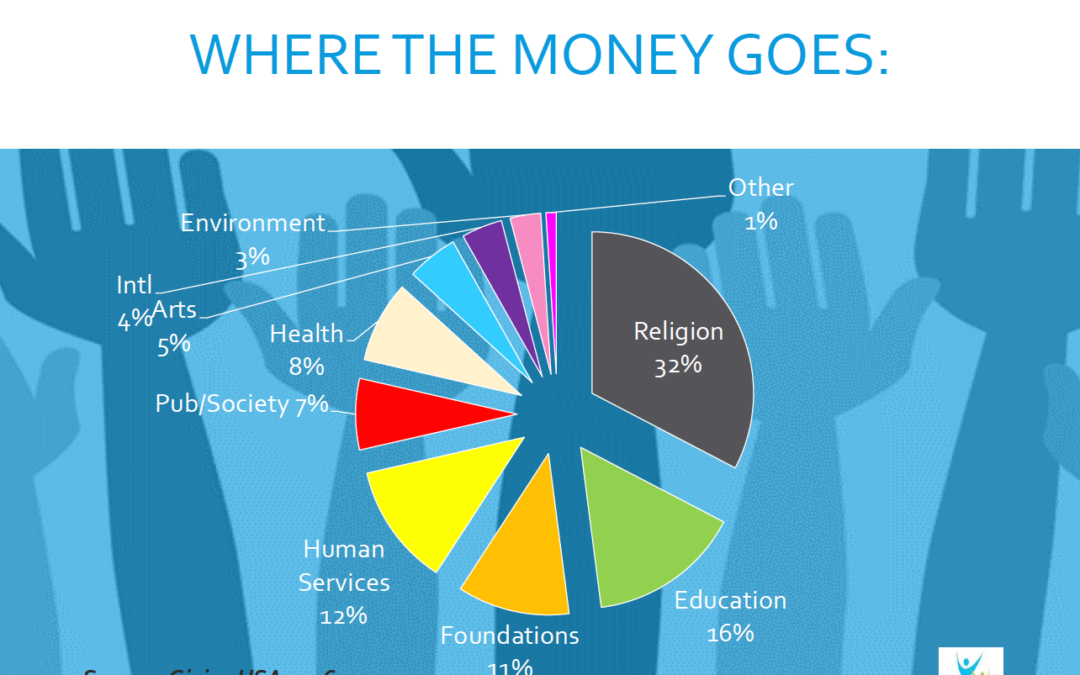

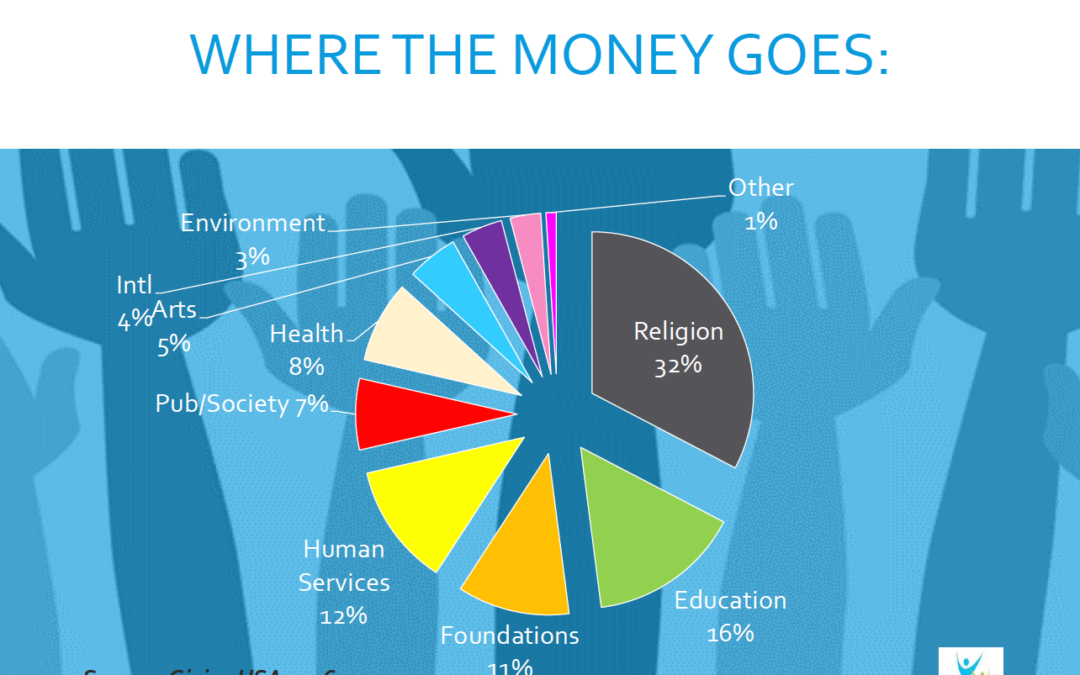

In our ongoing effort to help make planned giving more accessible, collaborative and beneficial for charities, we hosted a workshop led by fundraising expert Laura Kaufman. The fourth in our series of free seminars and workshops, Engaging Your Donors for Life-Long Giving, invited Chicago-area nonprofits to learn about strategies and tactics for engaging donors over a long time horizon. Laura covered three major areas with us: The Individual Donor (ID) Marketplace. What is Engagement and Why Does It Matter? Driving Donor Engagement. State of Giving: National and Chicago Area Trends Nonprofits are experiencing more giving than ever before. In each category, numbers are on the rise, year over year. According to Giving USA’s report, giving by bequest is up 2.1%, giving my individuals is up 3.8% and total giving has increased 4.4%. The next question is, where is the money going? This chart from Giving USA breaks it down nicely. Drilling down to the specific Chicago area market, the Chicago Community Trust shared some interesting data. Compared to a national average of 59%, 73% of Chicagoans give to charity. 49% of Chicago households volunteer and 78% of dollars donated by Chicagoans stay in the region. What is Engagement: Often overlooked, donor engagement is absolutely critical for the long-term health of an organization. While nonprofit fundraisers are busy managing many initiatives for their organization, donor engagement must be the core of their day-to-day. Research shows doing so will make capital and annual giving campaigns go more smoothly, netting better results. The donor engagement cycle can be broken down into these simple components: Recruit/Inspire, Learn, Engage, Ask, Thank, Repeat, Upgrade and...

by Andrew Hibel | Mar 20, 2017 | Charitable Giving, Donor-Advised Funds, Featured |

On May 30, 1985, I skipped high school. No, it was not senior skip day, nor did I really desire a break from school. I wanted to travel from Appleton to Oshkosh to see President Reagan speak. He had just introduced his plan on what would eventually become the Tax Reform Act of 1986 and first went to Wisconsin to sell it to the American people. Contrary to my parents wishes, I did hear the speech in person and watched the ensuing process that produced the new tax code. It was something that sparked my interest in learning about taxes and how (and why) they work the way they do. In law school, my intellectual curiosity about taxes turned towards the charitable deduction and was one of the major factors that drove me to pursue a career in charitable gift planning. I fell in love with the fact that our country effectively allowed citizens to choose where their tax dollars could make a difference. Over the years, my admiration has grown into awe as I have participated in conversations about the deduction that sparked amazing charitable gifts changing the course, and even saving, countless lives. My awe of and now concern about the charitable deduction led me to go to Capital Hill on February 16th where I joined nearly 200 nonprofit leaders in a whirlwind day of meetings hosted by the Charitable Giving Coalition (@ProtectGiving). We visited 130 House of Representatives and Senate offices, including 23 members of the Senate Finance Committee and 26 members of the House Ways and Means Committee. The goal of these meetings was to...

by Andrew Hibel | Dec 21, 2016 | Donor-Advised Funds, Featured |

On December 9th, the markets hit their 13th record close since the November elections. Accompanying the records in the market, we have also seen what feels like a record number of opinions of what the change in administrations will mean for taxes. Some of these opinions have focused on the potential tax changes and their effects on the charities and the charitable deduction. Fidelity Charitable offered what I consider a measured and reasonable framework for the possibilities. It is safe to conclude that there is at least a good likelihood that the benefits of giving in 2016 may be more tax wise than in future years. If you believe that to be true, these next few days may be ideal for starting a donor advised fund. Here’s why: Tax Benefits in 2016, Grant in 2017 and Beyond: Right now, this simple and unique benefit of a donor advised fund could be its biggest. Donors can take a deduction in 2016 and reserve the right to recommend grants in future years. If you can use a tax deduction this year, you can get it and “lock-in” its’ benefits. You do not have to decide where you want its support to go at this time, you can choose the charity at a later date. You Don’t Need to be Bill Gates: If you have been following donor advised funds for several years, you may remember the gift minimums to be $25,000 and above. These minimums have come down over the years. In fact, The Advise Us Fund‘s gift minimum is $2,500. With the lower minimums, it may be feasible to “pre-pay”...

by Andrew Hibel | Dec 13, 2016 | #GivingTuesday, Donor-Advised Funds, Featured, Linked In |

Remember to support the nonprofits you love this holiday season and if we are among them, thank you! Help support our work by donating at...

by Andrew Hibel | Nov 23, 2016 | Donor Impact, Featured, Linked In |

As the end of the year approaches, it is easy to get caught up in the hustle of all the things to get done, the preparing, perhaps traveling, the celebrations to attend or maybe even something difficult that’s keeping your attention. Through all of this, we hope you can take pause and just ponder all of the things that you have to be thankful for. Today, we are doing just that, and we can certainly look to YOU with such appreciation and thanks for your interest in or support of The Advise Us Fund. It’s been a tremendous year, and all that we are doing to work to help others and fulfill our mission would not be possible without your support. We hope you and your family have a wonderful Thanksgiving and many good wishes as we embark on 2017! From generation to generation, The Board of Directors, Staff and Volunteers of The Advise Us...