by Hiram Wurf | Jun 9, 2015 | Donor Intent, Donor-Advised Funds, Featured |

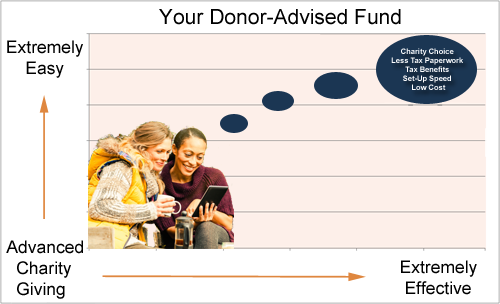

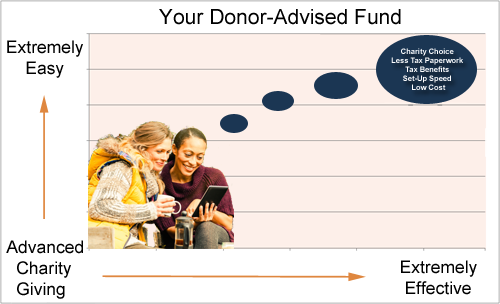

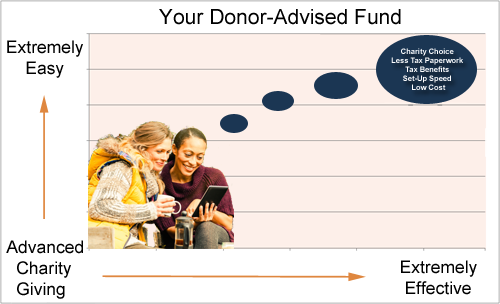

We’re big fans of donor-advised funds because they offer donors an easy and effective charitable experience. Donor-advised funds give you a great tool that lets you focus on the joys of charitable giving. 5 Easy and Effective Contributions to Your Charity Experience Here are five benefits donor-advised funds bring to your charitable experience. 1. Charity Choice – You have a lot of options. Donor-advised funds let you donate to 501(c)3 public charities – giving you over 1 million choices, including most well-known (and many lesser-known) nonprofit organizations. 2. Less Tax Paperwork – Don’t like paperwork? No problem! Donor-advised fund sponsors handle almost everything. You just keep receipts from your tax deductible contributions to your fund for your personal tax filings. 3. Tax Benefits – Ready for a less taxing experience? You can save more, give easier and give better with these donor-advised fund tax advantages. 4. Set-Up Speed – It’s fast! Fill out the application and send it in with your contribution. It’s really that simple. Your donor-advised fund sponsor will process your application and you’ll be ready to start engaging in smarter philanthropy. 5. Low Cost – Donor-advised funds don’t cost much at all. Compared to many other advanced charitable giving vehicles – such as foundations and trusts – donor-advised funds offer tremendous value. With only modest administrative and investment fees you avoid legal and accounting fees that other vehicles require. This means more of your money goes where you want it to go – to charity. Great Charitable Opportunity for Donors Donor-advised funds offer donors an opportunity to make their charitable giving better. The ease and efficiency...

by Andrew Hibel | May 26, 2015 | Donor Impact, Donor Intent, Featured |

Donors give to charity because it “feels good” to give. Usually donors feel good when they believe their contribution “makes a difference.” I know that makes me feel good! But how do you know if your donation makes a difference? There are a number of charity metrics – including defining what success looks like, “on-the-ground” testimonials from those who benefit from donor generosity, and impact reports – that can help donors appreciate how a nonprofit succeeds at its mission. Critically, the process requires organizational management, data collection and analysis, and communicating success with donors. And that costs money. They’re “overhead” costs. Frequently overhead costs come up when assessing charity “worthiness” – and there’s nothing wrong with that. Nonprofit expenses, including overhead, should be in line with good charitable practices. Inflated administrative salaries do not make charity better. But “normal” administrative costs do make nonprofit organizations better. Administrative and development personnel – paid a fair wage – provide critical nonprofit infrastructure. That infrastructure is critical to achieving charitable missions. Charity overhead matters. How should we measure overhead? While we often see overhead listed as a percentage of overall expenses, that alone is a poor measure. Measuring overhead requires context. Start-up and smaller charities may have a higher overhead because of their developmental stage. Some charitable missions may require more administration. For example, organizations with a lot of program staff or volunteers may need more human resources administration. On the flip side, larger charities often have economies of scale that permit them to spend less on overhead. Does that mean that only larger nonprofits can really “make a difference” in their...

by Rosalyn Lambert | Apr 22, 2015 | Charitable Remainder Trust, Donor Intent, Donor-Advised Funds, Featured |

Bequests are the third highest source of income for charity totaling $28 billion in 2013. While big bequests going to big nonprofits may make news, the average bequest is between $35,000 and $75,000 according to 2011 research by Blackbaud, Inc.* That’s funding that can make a big difference for a small- or mid-sized charity’s mission – especially when numerous donors give. While any charity can receive a bequest – smart charities try to improve their chances. Why? Because becoming a bequest successor is a real commitment from your donor –a vote of confidence in your mission. Financially it funds your mission now and later. Most people understand eventual bequest funding, but fewer understand what it means now. Donors who make bequest commitments average more than double the annual gifts of other donors. Even donors just considering a bequest give over 25% more annually than those who aren’t considering a bequest. As Emily Krauser points out in her groundbreaking research “For a fund raiser, being named in a donor’s will is a great way to build lifetime commitment to an organization. Increasing the number of individuals with a charity named in their wills not only will increase the future dollar amount given by bequest, but may also increase donor loyalty and inter-vivos giving [i.e. giving during the donor’s lifetime].” Bequest donors are among your most important donors – or they can be, if you cultivate them. Read on for ways you can improve your bequest program. [If you don’t have a bequest program it’s easy to start one and we can help (contact us) – it’s part of our charitable...

by Andrew Hibel | Apr 14, 2015 | Donor-Advised Funds, Featured |

Are you ready for a great opening day? Opening a donor-advised fund is easy, but covering the four bases below means you’ll get the most out of your fund starting from day one. Maximize Contribution Benefits with Your Donor-Advised Fund. Consider giving long-term (held over a year) appreciated securities to your donor-advised fund. This can avoid capital gains tax and maximize your charitable tax deduction. Keep the Right Tax Records – It’s Easy. Gifts to your donor-advised fund may be tax deductible. Those are the records to keep for your taxes. You do not need to keep tax records for grants you advise from your donor-advised funds to charities. You cannot claim donor-advised fund grants on your taxes. Schedule Grant Advisements – It’s Easy. Consider scheduling regular or future one-time charitable gifts. The grant advisement process is easy. You don’t have to remember and take the time to make a gift when you’re busy, like during the holiday season. Your Donor-Advised Fund Can Contribute to Estate Plans. Donor-advised funds offer flexible options for estate planning. Consider advising a grant from your fund to one or more charities that you care most about. Consider leaving the right to make grant advisements from the fund to your heir(s). Consider funding a donor-advised fund for your heir(s) from your estate to leave a legacy of charitable giving. Donor-advised funds make it easy to field a winning team with flexible and tax-efficient charitable giving. Covering the four bases above can make your donor-advised fund experience easier and more fulfilling starting opening day. ____________ Andrew Hibel serves as President and is the Founder of...

by Andrew Hibel | Mar 18, 2015 | Donor-Advised Funds, Featured |

Donor-advised funds offer easy and flexible charitable giving with great tax planning benefits. Here are five ways to benefit from donor-advised funds during tax season. Centralize Giving and Records. Stop searching for donation receipts. Donor-advised funds let you focus on one charity for tax purposes. All your donation records come from your fund. You can plan the amount you want to give easier, advise grants to the numerous charities you care most about, and you don’t need to worry about writing and mailing numerous checks (donor-advised fund administrators distribute your donations too). Harvest Gains and Rebalance Your Portfolio. Contributing appreciated assets to charity can offer greater tax-savings than donating cash. Donating appreciated securities, at fair market value if held more than a year, to your donor-advised fund can provide a charitable deduction that helps off-set capital gains taxes. You can also strategically rebalance your portfolio. Donating low basis appreciated securities can increase your portfolio’s overall cost basis. Budget and Schedule Your Giving. How much do you want to give this year? Next year? Donor-advised funds make it easy to see how much you’re giving and to whom because the information is all in one place. Do you give regularly to one or more charities during the busy holidays – or some other time that isn’t convenient to remember and take the time to do it? Schedule your grant advisements in advance, when it’s convenient for you, for the time(s) you want to gift to charity. Your donor-advised fund will take care of it. Separate Donating from Gift Giving. You should donate at the optimal time for you tax-wise and...