by Andrew Hibel | Apr 18, 2018 | Charitable Giving, Donor-Advised Funds, Featured, Linked In, Taxes |

The rules of the game are largely unchanged – it’s just that many taxpayers won’t be playing anymore The Tax Cuts and Jobs Act of 2017 is the legislative centerpiece of President Trump’s first year in office. The law increases the standard deduction, likely reducing taxpayers’ motivation to itemize deductions. While experts differ, most expect this change to have a negative effect on charitable giving. Donors who care about the mission and futures of the nonprofits they support should pay attention to what’s a fact, and what’s speculation, about the potential effects of this far-reaching act. Speculation: The act will limit charitable giving. No one knows the answer to this question – in fact, I suggest that no one knows if we’ll ever know! The effect will not be apparent soon, and when it arrives will very likely be buried amid other economic factors: a continued strong economy (and sustained donations) may suggest to some that there is no effect, while a troubled economy might exaggerate any interpretation. Trying to ferret out the law’s effect might be akin to trying to figure out which specific drink caused your hangover. Since a conclusive answer to the overall effect may be hard to come by, maybe the best strategy for scrambling nonprofits is to understand that itemization (and charitable giving) will continue to be a case by case decision for every donor. There’s nothing new about that – the key, as always, will be to send clear messages and build strong relationships (though perhaps with a bit more urgency than ever before). The tax law might leave a hole in your...

by Andrew Hibel | Apr 12, 2018 | Events, Featured, Linked In |

When your nonprofit organization’s CEO says “Do you take this strategic plan to have and to hold?,” can you say “I do!” with conviction? Being called upon to fund strategies that did not fully consider donors and development is justifiably every fundraiser’s nightmare. There should be a symbiosis between an organization’s strategic plans and its fundraising expectations, but that’s not always the case. Using real-world, cautionary tales of planning processes that succeeded or went awry and how fundraisers responded, this session equips organization executives, board members and development leaders with the perspective they need to ensure that strategic plans drive fundraising success – and vice versa. Join us for this free, 2-hour seminar, May 14, 9:00 am – 11:00 am presented by Doug Diefenbach, Principal, Diefenbach Communications Strategies Forefront, 208 South LaSalle Street, #1540 Chicago, IL Click here to reserve your spot today! Doug Diefenbach is an accomplished consultant with special expertise in the area of nonprofit and philanthropic marketing. For more than 30 years, in both executive and consulting roles, he has helped a wide range of organizations to develop, meet and exceed their goals for strategic alignment, brand visibility, constituent engagement and philanthropic...

by Andrew Hibel | Oct 31, 2017 | Charitable Giving, Featured, Linked In |

I’ve found myself engaged in a good deal of conversations about the charitable deduction in 2017, but I still haven’t found what I am looking for (Just in case you care, the version of the U2 classic song that I prefer is this one (with Bruce Springsteen). Today, I spent a second day of 2017 on Capitol Hill. The National Association of Charitable Gift Planners gathered 800 professionals in Baltimore for its national conference this week. Fifty of us met with 62 Senator and Representative’s offices. In fact, we met with staff from 10 of the 26 Members of the Senate Finance Committee. We had done something similar in February where we were discussing Speaker Ryan’s “Blueprint”. but today was very different. We are on the verge of getting a tax reform Bill. The “Big Six” in the Senate issued a 9 page plan which outlined their goals for reform and while thjs plan does not offer a lot of detail about how tax reform would actually occur, I know what I was looking for… the Universal Charitable Deduction. On the face of it, the plan seems to simplify the tax process. It doubles the standard deduction while retaining the charitable deduction for those that itemize. As one representative said today “I thought they spared the charitable deduction.” While on its face it appears they spared the charitable deduction, in fact, the plan could end costing the charitable community up to $14.7 billion per year. Currently, roughly 1 of 3 of taxpayers itemized their deductions. It is estimated that when the standard deduction is doubled, around 1 of 20...

by Amy Roy | Jul 10, 2017 | Charitable Giving, Featured, Linked In |

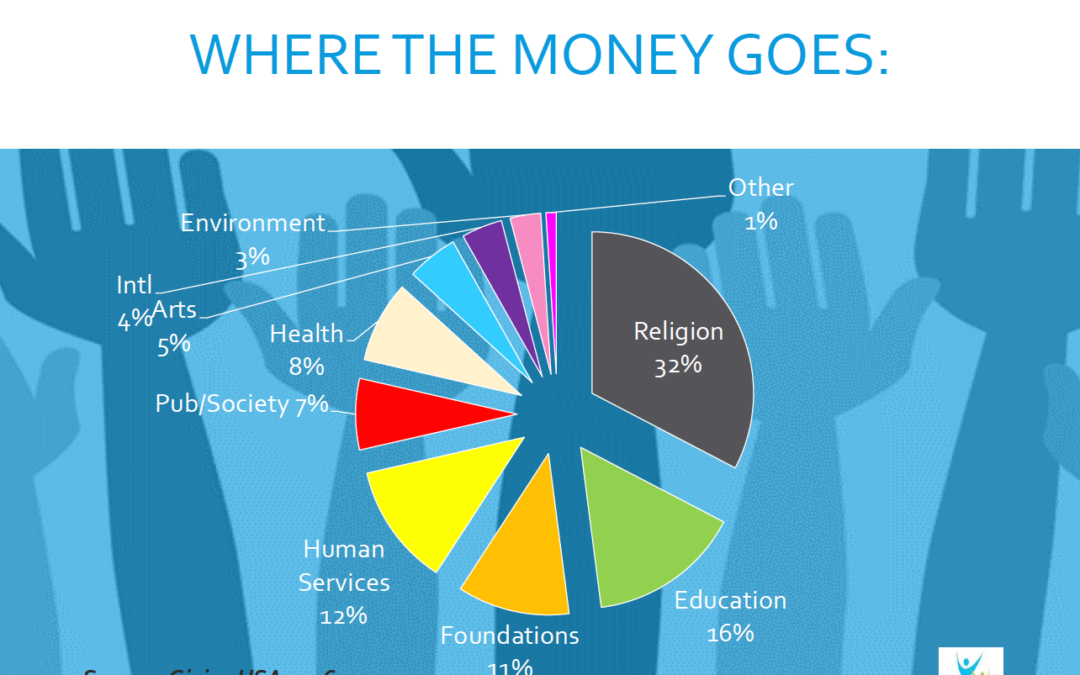

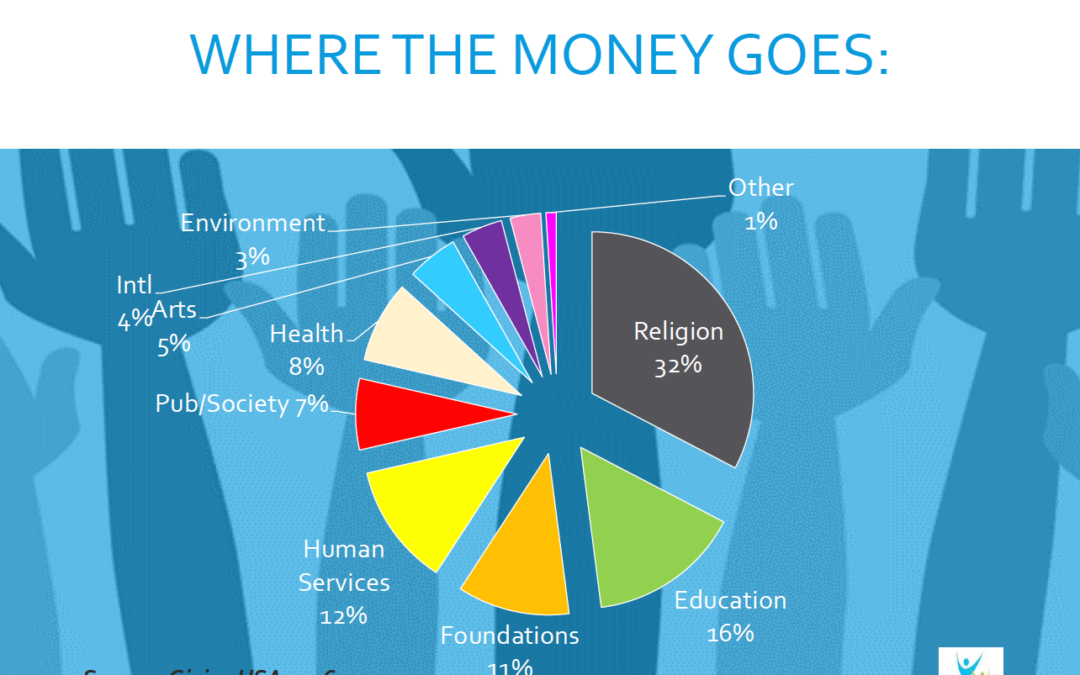

In our ongoing effort to help make planned giving more accessible, collaborative and beneficial for charities, we hosted a workshop led by fundraising expert Laura Kaufman. The fourth in our series of free seminars and workshops, Engaging Your Donors for Life-Long Giving, invited Chicago-area nonprofits to learn about strategies and tactics for engaging donors over a long time horizon. Laura covered three major areas with us: The Individual Donor (ID) Marketplace. What is Engagement and Why Does It Matter? Driving Donor Engagement. State of Giving: National and Chicago Area Trends Nonprofits are experiencing more giving than ever before. In each category, numbers are on the rise, year over year. According to Giving USA’s report, giving by bequest is up 2.1%, giving my individuals is up 3.8% and total giving has increased 4.4%. The next question is, where is the money going? This chart from Giving USA breaks it down nicely. Drilling down to the specific Chicago area market, the Chicago Community Trust shared some interesting data. Compared to a national average of 59%, 73% of Chicagoans give to charity. 49% of Chicago households volunteer and 78% of dollars donated by Chicagoans stay in the region. What is Engagement: Often overlooked, donor engagement is absolutely critical for the long-term health of an organization. While nonprofit fundraisers are busy managing many initiatives for their organization, donor engagement must be the core of their day-to-day. Research shows doing so will make capital and annual giving campaigns go more smoothly, netting better results. The donor engagement cycle can be broken down into these simple components: Recruit/Inspire, Learn, Engage, Ask, Thank, Repeat, Upgrade and...

by Andrew Hibel | Dec 13, 2016 | #GivingTuesday, Donor-Advised Funds, Featured, Linked In |

Remember to support the nonprofits you love this holiday season and if we are among them, thank you! Help support our work by donating at...