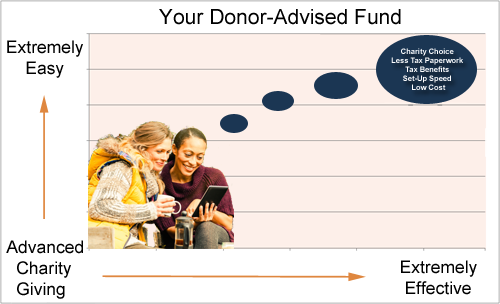

What is a donor-advised fund? Donor-advised funds are charitable gifting programs administered by a public charity and created to manage donations for donors (individuals, families or organizations). Many people find donor-advised funds flexible and easy-to-use – and they offer charitable, financial and tax planning advantages for many donors.

5 Benefits Contributing to Your Charity Experience

Donor-advised funds give you a great tool that lets you focus on the joys of charitable giving. Here are five benefits donor-advised funds bring to your charitable experience.

Big Bequest Opportunity – Small- to Mid-Sized Charity Funds

The average bequest is between $35,000 and $75,000. That’s funding that can make a big difference for a small- or mid-sized charity’s mission – especially when numerous donors give.

Contribute to Donor-Advised Fund Opening Day – Cover 4 Bases

Are you ready for a great opening day? Opening a donor-advised fund is easy, but covering the four bases below means you’ll get the most out of your fund starting from day one.

Smart Charity – 5 Tax Benefits Donor-Advised Funds Contribute

Donor-advised funds offer easy and flexible charitable giving with great tax planning benefits. Five ways to benefit from donor-advised funds during tax season.

Donor-Advised Funds Big Contributors to Unrestricted Support – 7 Reasons That’s Great!

Why do charities need unrestricted support? In many cases general operating funds not only keep the lights on – they also contribute to the effectiveness of charity program development and implementation.

Donor-Advised Funds’ Soul – Offering Unique Contribution to Donors & Charity

Donor-advised funds have reached a crossroads in the charitable community – and we must choose their future path.

Beyond the Charitable IRA Rollover – the Unique Charitable Alt-IRA

The Charitable Alt-IRA technique offers many and perhaps most donors a better alternative than the Charitable IRA Rollover.

Donor-Advised Funds Contribute to Fundraising Success

In my life as a development officer I hated donor-advised funds. Now I see donor-advised funds in an entirely new light because I better understand their important role – and potential – in charitable giving.

Donor-Advised Fund to Align Company & Executive Philanthropy

E.W. Scripps Co. Chair, President & CEO Rich Boehne seeks a $1M donor-advised fund in his name as employment compensation. Using a donor-advised fund to align corporate and management philanthropic interests could be a future trend for executive compensation.

Donor-Advised Funds – 3 Planned Giving Advantages for Younger Generations

The biggest donors in America may be using donor-advised funds – but they aren’t the only ones.

Donating Stock to Charity – 2 Steps and 2 Benefits

Donating stock to charity is often the best method of charitable giving – but timing makes a difference! You want to give your stock at the right time for you and donate at the right time for you – and those times are often different.

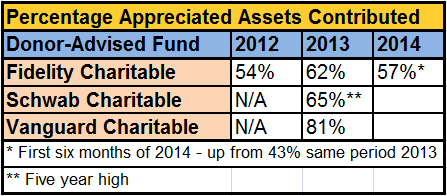

Appreciated Asset Gifts to Donor-Advised Funds on the Rise

Trending with the growth of financial markets, donors are increasingly giving appreciated assets as contributions to their donor-advised funds.