by Andrew Hibel | Nov 9, 2017 | Charitable Giving, Donor-Advised Funds, Featured |

Representative Mark Walker of North Carolina has proposed the Universal Charitable Deduction which would allow non-itemizers to deduct their gifts in addition to taking the standard deduction. The bill caps the deduction at one-third of the standard deduction. The charitable community likes the universal concept, but many are wondering if the cap is needed as it can impact gifts from donors who don’t use the itemized deduction. Financial advisors often speak with their clients about charitable giving and, currently, many of those clients itemize their deductions. However, if as proposed in the “Big Six” in the Senate’s 9-page plan, the standard deduction would double and the itemized deduction for state and local taxes would not. If tax reform results in changes that affect the standard deduction, here are the reasons why financial advisors should support the Universal Charitable Deduction: The “Big Six” Plan Reduces Itemizers by almost 85% —This is estimated to reduce the percentage of taxpayers using the itemized deductions from 33% to 5%. Simply put, there could be significantly fewer clients itemizing their deductions without the Universal Charitable Deduction. Nothing Beats Appreciated Securities for Charitable Giving — Charitable giving is still one of the most tax efficient ways of working with large capital gains. These benefits are amplified with use of a donor-advised fund to help the client manage their grants to their favorite non-profits. Charitable Giving Builds Client Relationships — Clients can express the values and causes that are most important to their lives through their charitable giving. In many instances, how people donate their wealth will better explain their deeply valued desires than how they...

by Andrew Hibel | Oct 31, 2017 | Charitable Giving, Featured, Linked In |

I’ve found myself engaged in a good deal of conversations about the charitable deduction in 2017, but I still haven’t found what I am looking for (Just in case you care, the version of the U2 classic song that I prefer is this one (with Bruce Springsteen). Today, I spent a second day of 2017 on Capitol Hill. The National Association of Charitable Gift Planners gathered 800 professionals in Baltimore for its national conference this week. Fifty of us met with 62 Senator and Representative’s offices. In fact, we met with staff from 10 of the 26 Members of the Senate Finance Committee. We had done something similar in February where we were discussing Speaker Ryan’s “Blueprint”. but today was very different. We are on the verge of getting a tax reform Bill. The “Big Six” in the Senate issued a 9 page plan which outlined their goals for reform and while thjs plan does not offer a lot of detail about how tax reform would actually occur, I know what I was looking for… the Universal Charitable Deduction. On the face of it, the plan seems to simplify the tax process. It doubles the standard deduction while retaining the charitable deduction for those that itemize. As one representative said today “I thought they spared the charitable deduction.” While on its face it appears they spared the charitable deduction, in fact, the plan could end costing the charitable community up to $14.7 billion per year. Currently, roughly 1 of 3 of taxpayers itemized their deductions. It is estimated that when the standard deduction is doubled, around 1 of 20...

by Robert Freedman | Oct 2, 2017 | Charitable Giving, Donor Impact, Featured |

Over the past 10 days Jews around the world, myself included, observed the High Holy Days, Rosh Hashanah and Yom Kippur. During these days, I along with countless others, turned our thoughts towards Tikkun Olam (repairing the world) and Tzedakah (charity). Between the trio of powerful hurricanes that ripped through the Caribbean and the southeastern United States, powerful earthquakes devastating neighboring Mexico, and the ongoing struggles of poverty, poaching, and refugees in central Africa, there is no shortage of need around the world. As I reflected on my own faith traditions of helping those in need, I was prompted to think about what other faith traditions say about charitable giving, especially during their highest holy days. Uniting Christianity, Buddhism, Islam, and Judaism (amongst other things) is charitable giving. Here are some thoughts on charitable giving from these traditions: For Christians, the role of charity is first built on teachings in the Hebrew Bible. However, in addition to Hebrew teachings of performing mitzvahs are lessons in the New Testament. Jesus’s parables and actions also speak to the morality of charitable sentiments. The Gospel of Luke, for example, notes “love thy neighbor as thyself” and asks Jesus, “Who is my neighbor?” The lesson is that we are interconnected, everyone is my neighbor and thus all should be considered. Buddhists also see the interdependence of all things and have an awareness of the helplessness of those less fortunate. Practicing selflessness in this way is thought to increase one’s own merit and is also seen as an antidote to greed. Giving is an expression of the natural qualities of kindness and compassion....

by Amy Roy | Jul 10, 2017 | Charitable Giving, Featured, Linked In |

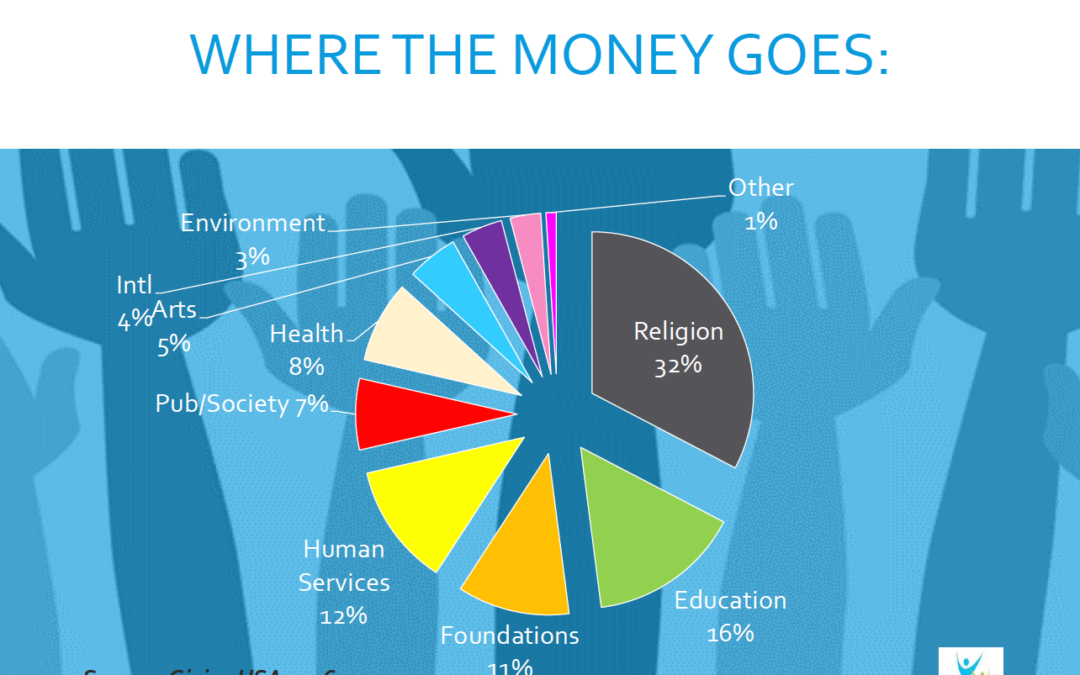

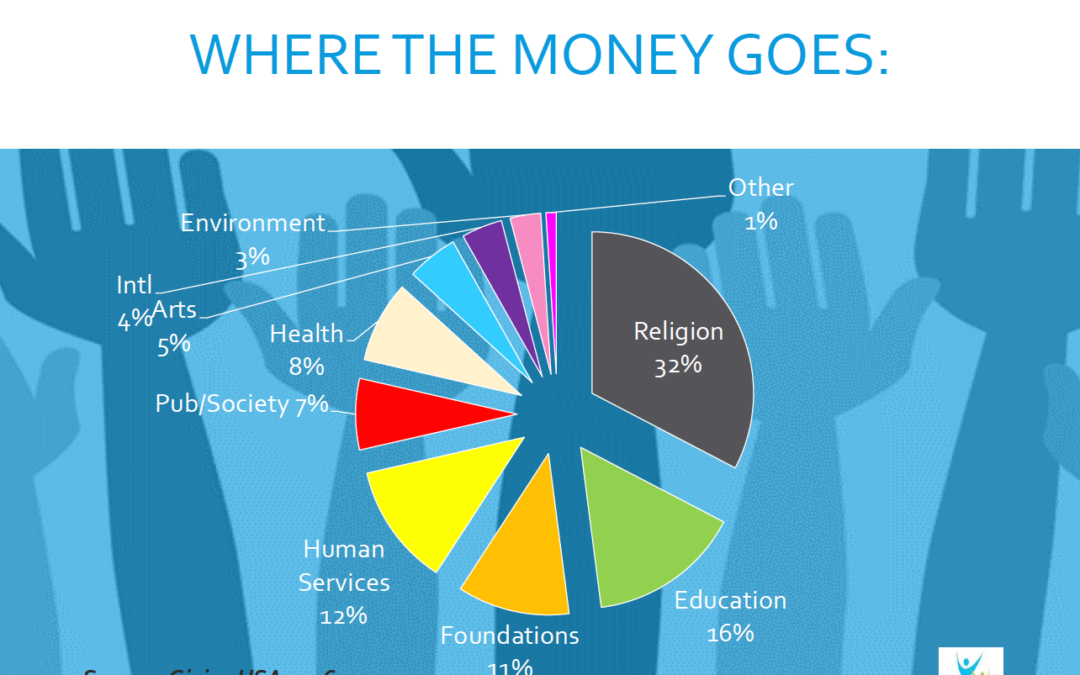

In our ongoing effort to help make planned giving more accessible, collaborative and beneficial for charities, we hosted a workshop led by fundraising expert Laura Kaufman. The fourth in our series of free seminars and workshops, Engaging Your Donors for Life-Long Giving, invited Chicago-area nonprofits to learn about strategies and tactics for engaging donors over a long time horizon. Laura covered three major areas with us: The Individual Donor (ID) Marketplace. What is Engagement and Why Does It Matter? Driving Donor Engagement. State of Giving: National and Chicago Area Trends Nonprofits are experiencing more giving than ever before. In each category, numbers are on the rise, year over year. According to Giving USA’s report, giving by bequest is up 2.1%, giving my individuals is up 3.8% and total giving has increased 4.4%. The next question is, where is the money going? This chart from Giving USA breaks it down nicely. Drilling down to the specific Chicago area market, the Chicago Community Trust shared some interesting data. Compared to a national average of 59%, 73% of Chicagoans give to charity. 49% of Chicago households volunteer and 78% of dollars donated by Chicagoans stay in the region. What is Engagement: Often overlooked, donor engagement is absolutely critical for the long-term health of an organization. While nonprofit fundraisers are busy managing many initiatives for their organization, donor engagement must be the core of their day-to-day. Research shows doing so will make capital and annual giving campaigns go more smoothly, netting better results. The donor engagement cycle can be broken down into these simple components: Recruit/Inspire, Learn, Engage, Ask, Thank, Repeat, Upgrade and...

by Andrew Hibel | Mar 20, 2017 | Charitable Giving, Donor-Advised Funds, Featured |

On May 30, 1985, I skipped high school. No, it was not senior skip day, nor did I really desire a break from school. I wanted to travel from Appleton to Oshkosh to see President Reagan speak. He had just introduced his plan on what would eventually become the Tax Reform Act of 1986 and first went to Wisconsin to sell it to the American people. Contrary to my parents wishes, I did hear the speech in person and watched the ensuing process that produced the new tax code. It was something that sparked my interest in learning about taxes and how (and why) they work the way they do. In law school, my intellectual curiosity about taxes turned towards the charitable deduction and was one of the major factors that drove me to pursue a career in charitable gift planning. I fell in love with the fact that our country effectively allowed citizens to choose where their tax dollars could make a difference. Over the years, my admiration has grown into awe as I have participated in conversations about the deduction that sparked amazing charitable gifts changing the course, and even saving, countless lives. My awe of and now concern about the charitable deduction led me to go to Capital Hill on February 16th where I joined nearly 200 nonprofit leaders in a whirlwind day of meetings hosted by the Charitable Giving Coalition (@ProtectGiving). We visited 130 House of Representatives and Senate offices, including 23 members of the Senate Finance Committee and 26 members of the House Ways and Means Committee. The goal of these meetings was to...